While some investors view Alibaba as a golden opportunity to tap into China's booming digital economy, others remain cautious due to the uncertainties surrounding the company's regulatory environment and leadership changes. The stock has experienced significant volatility, driven by factors such as China's crackdown on tech giants, global economic headwinds, and concerns over corporate governance. Despite these challenges, Alibaba continues to innovate and expand its ecosystem, raising questions about whether its current valuation reflects its true potential or if it remains a risky bet for investors. This article delves into the key debates surrounding Alibaba Group Holding Limited stock, exploring the factors that make it a polarizing choice for investors. From regulatory hurdles to market sentiment, we will examine the arguments for and against investing in Alibaba, while also addressing the broader implications of these debates for the tech sector. By the end of this piece, readers will have a comprehensive understanding of the risks and opportunities associated with Alibaba's stock, empowering them to make informed decisions.

Table of Contents

- What Are the Key Debates on Alibaba Group Holding Limited Stock?

- Who Is the Founder of Alibaba and What Is His Legacy?

- How Does Alibaba Group Holding Limited Operate?

- What Are the Regulatory Challenges Facing Alibaba?

- Is Alibaba Still a Good Investment in 2023?

- Why Does Alibaba Face Geopolitical Tensions?

- What Are the Future Prospects for Alibaba?

- Frequently Asked Questions About Alibaba Stock

What Are the Key Debates on Alibaba Group Holding Limited Stock?

The debates surrounding Alibaba Group Holding Limited stock are multifaceted, encompassing regulatory scrutiny, market sentiment, and the company's strategic direction. One of the primary concerns is the regulatory crackdown by the Chinese government, which has targeted tech giants like Alibaba for antitrust violations and unfair business practices. This has led to hefty fines and increased compliance costs, raising questions about the company's ability to maintain profitability in a stricter regulatory environment.

Another key debate centers on Alibaba's valuation. Despite its strong fundamentals and dominant market position, the stock has been trading at a discount compared to its peers. Some analysts argue that this reflects investor pessimism about China's regulatory landscape and the broader economic slowdown. Others, however, see this as an opportunity to buy into a company with immense growth potential, particularly as it expands into emerging markets and diversifies its revenue streams.

Read also:Eugenie Boisfontaine Update 2024 Latest Insights And Developments

Corporate governance is another contentious issue. While Alibaba has made strides in improving transparency and accountability, concerns linger about its dual-class share structure, which gives disproportionate voting power to insiders. This has sparked debates about whether the company is truly aligned with the interests of minority shareholders or if it prioritizes the vision of its leadership team.

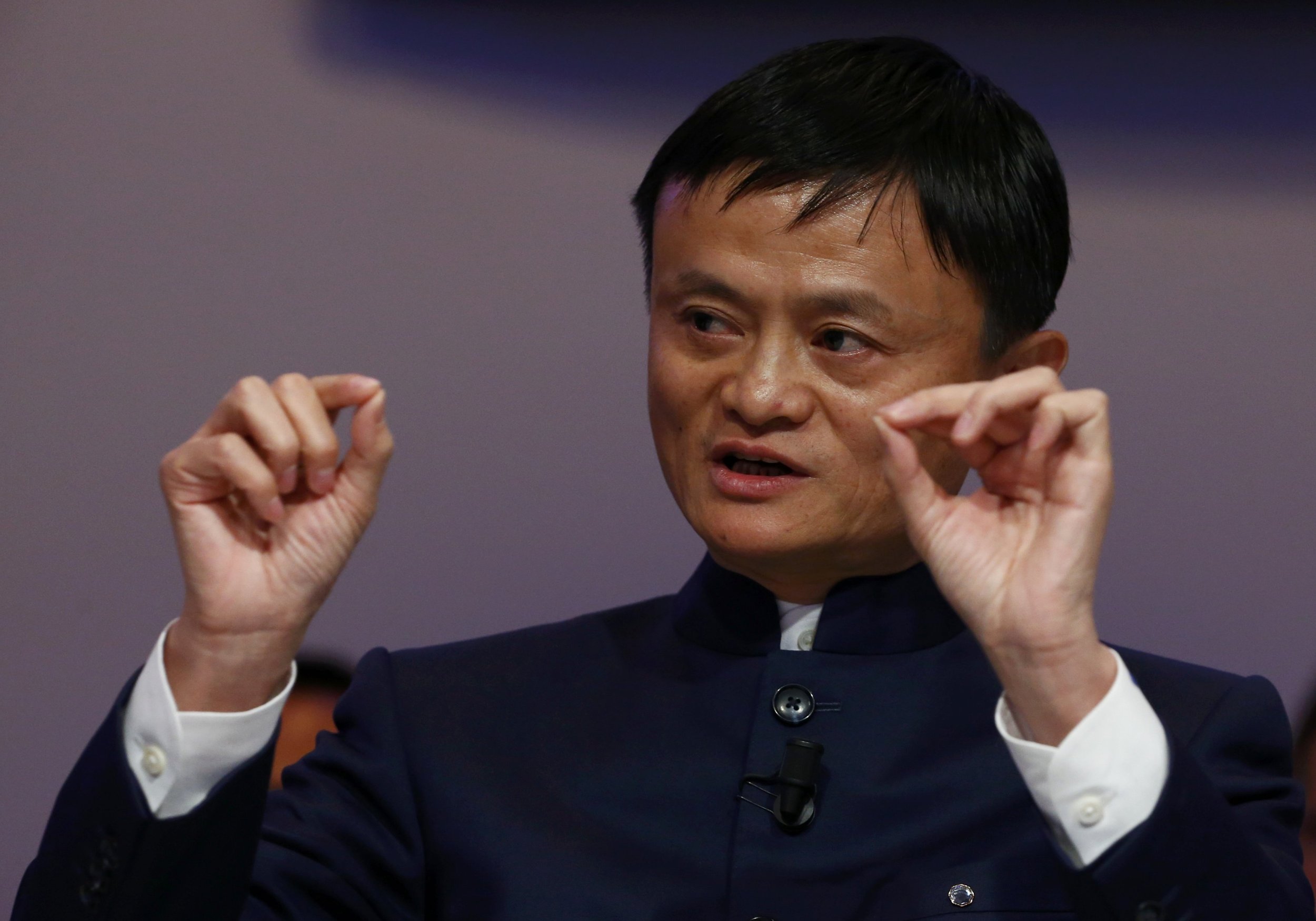

Who Is the Founder of Alibaba and What Is His Legacy?

Alibaba Group was founded by Jack Ma, a visionary entrepreneur who transformed the e-commerce landscape in China and beyond. His journey from an English teacher to one of the wealthiest individuals in the world is a testament to his entrepreneurial spirit and innovative mindset. Jack Ma's leadership played a pivotal role in shaping Alibaba's culture and driving its rapid growth.

Jack Ma's Personal Details

| Full Name | Ma Yun |

|---|---|

| Date of Birth | October 15, 1964 |

| Place of Birth | Hangzhou, Zhejiang, China |

| Education | Hangzhou Normal University |

| Net Worth | $30.6 billion (as of 2023) |

| Key Achievements | Founder of Alibaba Group, Co-founder of Ant Group |

Jack Ma's legacy extends beyond his business acumen. He has been a vocal advocate for entrepreneurship, education, and environmental sustainability. His philanthropic efforts through the Jack Ma Foundation have touched millions of lives, further cementing his status as a global icon. However, his recent retreat from public life amid regulatory pressures has sparked speculation about his influence on Alibaba's future direction.

How Does Alibaba Group Holding Limited Operate?

Alibaba Group Holding Limited operates as a conglomerate with a diverse portfolio of businesses spanning e-commerce, cloud computing, digital media, and financial services. At its core, Alibaba is best known for its e-commerce platforms, including Taobao, Tmall, and Alibaba.com, which connect millions of buyers and sellers across the globe. These platforms leverage advanced technologies such as artificial intelligence and big data to enhance user experience and drive sales.

What Are the Key Revenue Streams for Alibaba?

Alibaba's revenue streams can be categorized into three main segments:

- E-commerce: This includes online marketplaces like Taobao and Tmall, as well as cross-border platforms like AliExpress.

- Cloud Computing: Alibaba Cloud is one of the largest cloud service providers in Asia, offering solutions for businesses of all sizes.

- Digital Media and Entertainment: This segment includes streaming services, gaming, and content production, catering to China's growing appetite for digital entertainment.

How Does Alibaba's Ecosystem Drive Growth?

Alibaba's ecosystem is designed to create a seamless experience for users across its platforms. For example, a consumer might start their journey by shopping on Taobao, then use Alipay for payment, and finally stream a movie on Youku Tudou. This interconnected approach not only enhances customer loyalty but also generates valuable data that Alibaba uses to refine its offerings and target advertising more effectively.

Read also:Van Damme Height A Complete Look At The Action Stars Stature And Legacy

What Are the Regulatory Challenges Facing Alibaba?

One of the most significant challenges facing Alibaba is the heightened regulatory scrutiny in China. The government's crackdown on tech giants has led to stricter antitrust laws, data privacy regulations, and restrictions on financial services. These measures aim to curb monopolistic practices and ensure fair competition, but they have also created headwinds for Alibaba's operations.

How Has Regulatory Action Impacted Alibaba's Stock?

The regulatory crackdown has had a profound impact on Alibaba's stock price. In 2020, the company faced a record $2.8 billion fine for antitrust violations, which sent shockwaves through the market. Since then, investor confidence has been shaky, with the stock experiencing significant volatility. Analysts are divided on whether these regulatory actions will lead to long-term benefits, such as a more level playing field, or if they will stifle innovation and growth.

What Are the Broader Implications for the Tech Sector?

The regulatory challenges facing Alibaba are not isolated incidents but part of a broader trend affecting the tech industry in China. Other companies, such as Tencent and JD.com, have also come under scrutiny, signaling a shift in the government's approach to regulating the sector. This has raised concerns about the sustainability of China's tech boom and its impact on global markets.

Is Alibaba Still a Good Investment in 2023?

Investing in Alibaba in 2023 requires a careful assessment of both risks and opportunities. On one hand, the company's strong fundamentals, innovative capabilities, and dominant market position make it an attractive prospect for long-term investors. On the other hand, the ongoing regulatory challenges and geopolitical tensions pose significant risks that cannot be ignored.

What Are the Key Factors to Consider Before Investing?

- Valuation: Alibaba's stock is currently trading at a discount, which could present a buying opportunity for value investors.

- Regulatory Risks: Investors should monitor developments in China's regulatory landscape and assess their potential impact on Alibaba's operations.

- Growth Prospects: Alibaba's expansion into emerging markets and its focus on cloud computing and digital entertainment offer promising avenues for growth.

How Does Market Sentiment Affect Alibaba's Stock?

Market sentiment plays a crucial role in determining Alibaba's stock performance. Negative news, such as regulatory fines or geopolitical tensions, can lead to short-term volatility. Conversely, positive developments, such as strong earnings reports or strategic partnerships, can boost investor confidence and drive the stock higher. Understanding these dynamics is essential for making informed investment decisions.

Why Does Alibaba Face Geopolitical Tensions?

Alibaba's position as a leading Chinese tech company makes it vulnerable to geopolitical tensions, particularly between China and the United States. The ongoing trade war, sanctions, and concerns about data security have created a challenging environment for Alibaba to navigate. These tensions not only affect the company's operations but also influence investor sentiment and stock performance.

How Do Geopolitical Risks Impact Alibaba's Global Expansion?

Geopolitical risks have forced Alibaba to rethink its global expansion strategy. For example, the company has faced scrutiny in countries like India and the United States, where it has been accused of unfair trade practices and data privacy violations. As a result, Alibaba has had to adapt by focusing on markets with fewer regulatory hurdles and strengthening its partnerships with local players.

What Are the Long-Term Implications for Alibaba?

The long-term implications of geopolitical tensions for Alibaba are uncertain. While the company has demonstrated resilience in the face of adversity, the evolving global landscape presents both challenges and opportunities. By diversifying its revenue streams and investing in emerging technologies, Alibaba can mitigate some of the risks associated with geopolitical tensions and position itself for sustained growth.

What Are the Future Prospects for Alibaba?

Looking ahead, Alibaba's future prospects are shaped by its ability to innovate, adapt, and overcome challenges. The company's focus on cloud computing, artificial intelligence, and digital entertainment positions it well to capitalize on the next wave of technological advancements. Additionally, its commitment to sustainability and corporate social responsibility aligns with global trends and enhances its brand reputation.

However, the road ahead is not without obstacles. Regulatory scrutiny, geopolitical tensions, and intense competition will continue to test Alibaba's resilience. By maintaining a customer-centric approach and fostering a culture of innovation, Alibaba can navigate these challenges and unlock new opportunities for growth.

Frequently Asked Questions About Alibaba Stock

Is Alibaba Stock a Safe Investment?

While Alibaba offers significant growth potential, it is not without risks. Investors should carefully evaluate the company's regulatory environment, market dynamics, and geopolitical factors before making a decision.

What Are the Main Risks of Investing in Alibaba?

The main risks include regulatory crackdowns in China, geopolitical tensions, and market volatility. These factors can impact Alibaba's stock performance and should be monitored closely.

How Does Alibaba Compare to Other Tech Giants?

Alibaba is often compared to companies like Amazon and Tencent. While it shares similarities in terms of scale and innovation, its unique challenges, such as regulatory scrutiny in China, set it apart from its peers.

External Link: For more insights into Alibaba's financial performance, you can visit Alibaba's Investor Relations page.

In conclusion, the debates surrounding Alibaba Group Holding Limited stock reflect the complexities of investing in a rapidly evolving market. By