State Farm full coverage insurance is one of the most sought-after options for drivers seeking comprehensive protection for their vehicles. Whether you're a new driver or a seasoned road warrior, understanding the ins and outs of this policy can help you make informed decisions. Full coverage insurance typically includes liability, collision, and comprehensive coverage, ensuring you're protected in a variety of scenarios. With State Farm's reputation for reliability and customer service, it's no wonder so many drivers turn to them for their insurance needs.

When it comes to safeguarding your vehicle and financial well-being, State Farm full coverage insurance offers peace of mind. This type of policy not only covers damages to your car but also protects you in case of accidents involving other drivers. From fender benders to natural disasters, State Farm ensures you're covered. With customizable options and a wide network of agents, State Farm makes it easy to tailor a policy that fits your unique needs.

Choosing the right insurance provider is crucial, and State Farm has consistently ranked among the top choices for drivers nationwide. Their full coverage insurance plans are designed to provide maximum protection while remaining affordable. In this article, we'll explore the benefits, costs, and frequently asked questions about State Farm full coverage insurance. By the end, you'll have a clear understanding of why this policy might be the perfect fit for you.

Read also:Ray Charles Wife Bea Death A Deep Dive Into Her Life And Legacy

Table of Contents

- What is State Farm Full Coverage Insurance?

- Is State Farm Full Coverage Insurance Worth It?

- How Does State Farm Full Coverage Insurance Work?

- What Are the Benefits of State Farm Full Coverage Insurance?

- How Much Does State Farm Full Coverage Insurance Cost?

- What Factors Affect the Price of State Farm Full Coverage Insurance?

- How to Choose the Right State Farm Full Coverage Insurance Plan

- Frequently Asked Questions About State Farm Full Coverage Insurance

What is State Farm Full Coverage Insurance?

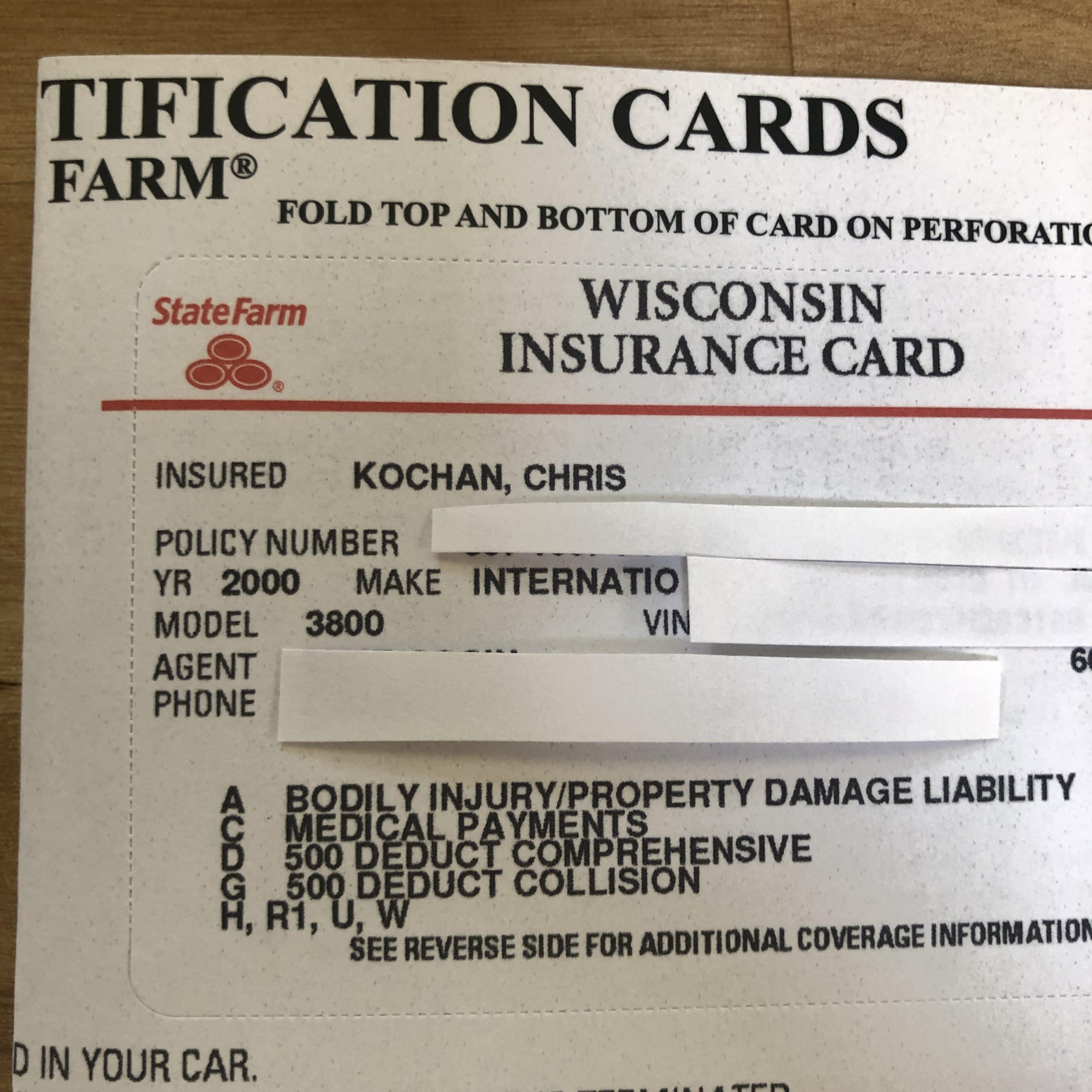

State Farm full coverage insurance is a comprehensive policy designed to provide extensive protection for your vehicle and financial security. Unlike basic liability insurance, which only covers damages to others in an accident you cause, full coverage insurance includes additional protections. These typically encompass collision coverage, which pays for repairs to your car after an accident, and comprehensive coverage, which handles damages from non-collision incidents like theft, vandalism, or natural disasters.

One of the standout features of State Farm full coverage insurance is its flexibility. Policyholders can customize their plans to include extras like roadside assistance, rental car reimbursement, and medical payments coverage. This adaptability ensures that drivers can tailor their policies to suit their specific needs and budgets. Additionally, State Farm's extensive network of agents and digital tools makes it easy to manage your policy, file claims, and get support whenever you need it.

State Farm's full coverage insurance also includes liability coverage, which is mandatory in most states. This component covers bodily injury and property damage you may cause to others in an accident. With State Farm's reputation for excellent customer service and claims handling, drivers can feel confident that they're in good hands. Whether you're a new driver or a long-time policyholder, understanding the components of full coverage insurance is essential for making informed decisions about your auto insurance needs.

Is State Farm Full Coverage Insurance Worth It?

When considering State Farm full coverage insurance, many drivers ask, "Is it worth the investment?" The answer largely depends on your individual circumstances. For those with newer or more expensive vehicles, full coverage insurance is often a wise choice. It ensures that you're protected against a wide range of potential damages, from collisions to natural disasters. This level of protection can save you from significant out-of-pocket expenses if something unexpected happens.

Another factor to consider is your risk tolerance. If you live in an area prone to severe weather, theft, or accidents, State Farm full coverage insurance provides an added layer of security. It also offers peace of mind, knowing that you're covered in various scenarios. Additionally, State Farm's reputation for reliable claims processing and customer service makes it a trusted option for many drivers. Their extensive network of agents and digital tools ensures that you can easily manage your policy and get support when needed.

On the other hand, if you own an older vehicle with a lower market value, the cost of full coverage insurance might outweigh the benefits. In such cases, basic liability coverage might suffice. However, for most drivers, the comprehensive protection offered by State Farm full coverage insurance is a valuable investment. It not only safeguards your vehicle but also provides financial security in case of accidents or unforeseen events.

Read also:Is Stephen Colbert On Vacation This Week Discover Whatrsquos Happening

How Does State Farm Full Coverage Insurance Work?

State Farm full coverage insurance operates by combining several types of coverage into one comprehensive policy. At its core, the policy includes liability coverage, which is mandatory in most states. This covers bodily injury and property damage you may cause to others in an accident. Additionally, collision coverage is included, which pays for repairs to your car after an accident, regardless of who is at fault. This ensures that your vehicle is repaired quickly and efficiently, minimizing downtime.

Another critical component is comprehensive coverage, which handles damages from non-collision incidents. This includes theft, vandalism, natural disasters, and even hitting an animal. Comprehensive coverage ensures that your vehicle is protected from a wide range of potential risks. State Farm also offers optional add-ons, such as roadside assistance, rental car reimbursement, and medical payments coverage. These extras can be tailored to fit your specific needs, providing additional peace of mind.

When you file a claim, State Farm's streamlined process ensures that you receive prompt and efficient service. Their extensive network of agents and digital tools makes it easy to manage your policy, file claims, and get support whenever you need it. Whether you're dealing with a minor fender bender or a major accident, State Farm's full coverage insurance provides the protection and support you need to get back on the road quickly and safely.

What Are the Benefits of State Farm Full Coverage Insurance?

One of the primary benefits of State Farm full coverage insurance is its comprehensive protection. This policy covers a wide range of potential risks, from collisions to natural disasters, ensuring that you're protected in various scenarios. With liability, collision, and comprehensive coverage included, you can drive with confidence, knowing that your vehicle and financial well-being are safeguarded.

Another significant advantage is the flexibility and customization options State Farm offers. Policyholders can tailor their plans to include extras like roadside assistance, rental car reimbursement, and medical payments coverage. This adaptability ensures that you can create a policy that fits your unique needs and budget. Additionally, State Farm's reputation for excellent customer service and claims handling makes it a trusted option for many drivers.

State Farm's extensive network of agents and digital tools also enhances the customer experience. Managing your policy, filing claims, and getting support is straightforward and convenient. Whether you're a new driver or a long-time policyholder, the benefits of State Farm full coverage insurance make it a valuable investment for protecting your vehicle and ensuring peace of mind on the road.

How Much Does State Farm Full Coverage Insurance Cost?

The cost of State Farm full coverage insurance varies based on several factors. Generally, premiums are influenced by your location, driving history, vehicle type, and coverage limits. On average, drivers can expect to pay between $100 and $200 per month for a full coverage policy. However, these figures can fluctuate significantly depending on individual circumstances.

What Factors Affect the Price of State Farm Full Coverage Insurance?

Several elements contribute to the cost of State Farm full coverage insurance. Your location plays a significant role, as areas with higher accident rates or theft risks often result in higher premiums. Additionally, your driving history, including any past accidents or traffic violations, can impact your rates. Vehicles with higher market values or those more expensive to repair may also lead to increased costs.

Other factors include the level of coverage you choose and any additional add-ons, such as roadside assistance or rental car reimbursement. Discounts, such as safe driver discounts or bundling multiple policies, can also affect the overall price. Understanding these variables can help you make informed decisions and potentially lower your insurance costs.

How to Choose the Right State Farm Full Coverage Insurance Plan

Selecting the right State Farm full coverage insurance plan requires careful consideration of your needs and budget. Start by evaluating your vehicle's value and your risk tolerance. If you own a newer or more expensive car, full coverage insurance is often a wise choice. It ensures that you're protected against a wide range of potential damages, from collisions to natural disasters.

What Should You Consider When Choosing a Plan?

When choosing a plan, consider the level of coverage you need and any additional add-ons that might benefit you. For instance, if you frequently travel, roadside assistance and rental car reimbursement could be valuable. Additionally, review your budget to determine how much you can afford to pay in premiums and deductibles. State Farm's customizable options allow you to tailor a policy that fits your unique needs.

It's also essential to compare quotes and explore available discounts. Safe driver discounts, bundling multiple policies, and maintaining a clean driving record can all help reduce your premiums. By taking these factors into account, you can select a State Farm full coverage insurance plan that provides the protection and peace of mind you need at a price you can afford.

Frequently Asked Questions About State Farm Full Coverage Insurance

What Does State Farm Full Coverage Insurance Include?

State Farm full coverage insurance typically includes liability, collision, and comprehensive coverage. Liability covers damages to others in an accident you cause, while collision pays for repairs to your car after an accident. Comprehensive coverage handles damages from non-collision incidents like theft, vandalism, or natural disasters.

Can I Customize My State Farm Full Coverage Insurance Policy?

Yes, State Farm offers customizable options for full coverage insurance. Policyholders can add extras like roadside assistance, rental car reimbursement, and medical payments coverage to tailor their plans to their specific needs and budget.

How Do I File a Claim with State Farm?

Filing a claim with State Farm is straightforward. You can file online, through their mobile app, or by contacting your local agent. State Farm's streamlined process ensures prompt and efficient service, helping you get back on the road quickly.

For more information about State Farm full coverage insurance, you can visit their official website.