Understanding State Farm auto coverage codes is crucial for anyone who wants to make the most of their car insurance policy. These codes serve as shorthand for the specific types of coverage included in your policy, helping you quickly identify the protection you have. Whether you're a new policyholder or reviewing your existing coverage, knowing these codes can save you time and help you make informed decisions. State Farm, one of the largest auto insurance providers in the U.S., uses these codes to categorize everything from liability coverage to roadside assistance, ensuring clarity and consistency in your policy documents.

Auto insurance can often feel like navigating a maze of technical jargon, but State Farm has simplified this process by implementing a system of codes that clearly define your coverage. These codes are not just random numbers and letters; they represent specific protections tailored to your needs. For instance, some codes might indicate liability coverage, while others could relate to comprehensive or collision coverage. By understanding these codes, you can ensure that your policy aligns with your driving habits, vehicle type, and financial situation.

Moreover, familiarity with State Farm auto coverage codes can empower you during policy renewal or when filing a claim. Whether you're adding a new vehicle to your policy or adjusting your coverage limits, these codes allow you to communicate effectively with your insurance agent. In this article, we’ll break down everything you need to know about State Farm auto coverage codes, including their meanings, how to interpret them, and why they matter for your peace of mind on the road.

Read also:The Ultimate Guide To La Unica Everything You Need To Know

Table of Contents

- What Are State Farm Auto Coverage Codes and Why Do They Matter?

- How to Decode Your State Farm Auto Insurance Policy?

- Common State Farm Auto Coverage Codes Explained

- Are You Fully Covered? Assessing Your State Farm Policy

- Customizing Your Coverage: What Options Are Available?

- How to File a Claim Using State Farm Auto Coverage Codes?

- Frequently Asked Questions About State Farm Auto Coverage Codes

- Conclusion: Navigating State Farm Auto Coverage Codes with Confidence

What Are State Farm Auto Coverage Codes and Why Do They Matter?

State Farm auto coverage codes are alphanumeric identifiers used to categorize the various types of coverage included in your auto insurance policy. These codes are designed to streamline communication between policyholders, agents, and claims adjusters by providing a standardized way to reference specific protections. For example, a code like "BI-250/500" might indicate bodily injury liability coverage with limits of $250,000 per person and $500,000 per accident. Understanding these codes ensures you know exactly what your policy covers and can help you avoid surprises during claims.

Why do these codes matter? For starters, they simplify the often complex world of auto insurance. Instead of wading through lengthy policy documents, you can quickly identify the coverage types and limits by referencing the codes. This is especially useful when comparing policies or shopping for additional coverage. Additionally, knowing your coverage codes can help you avoid underinsurance or overinsurance, ensuring you pay for exactly what you need.

Another reason these codes are essential is their role in claims processing. When you file a claim, your agent or claims adjuster will reference these codes to determine what is covered and what isn't. Misunderstanding your codes could lead to denied claims or unexpected out-of-pocket expenses. By familiarizing yourself with State Farm auto coverage codes, you can ensure a smoother claims process and maximize the benefits of your policy.

How to Decode Your State Farm Auto Insurance Policy?

Decoding your State Farm auto insurance policy might seem daunting at first, but with a little guidance, it becomes straightforward. The first step is to locate the declarations page of your policy, which typically lists all your coverage codes alongside their corresponding limits and premiums. This page serves as a summary of your policy and is the key to understanding your coverage.

Step 1: Identify the Coverage Codes

State Farm auto coverage codes are usually listed in a table format, with each code representing a specific type of protection. For example, "PD-100" might indicate property damage liability coverage with a $100,000 limit. Here’s a quick breakdown of common code categories:

- BI: Bodily Injury Liability

- PD: Property Damage Liability

- COLL: Collision Coverage

- COMP: Comprehensive Coverage

- UM: Uninsured Motorist Coverage

Step 2: Understand the Limits and Deductibles

Once you’ve identified the codes, the next step is to understand the limits and deductibles associated with each coverage type. Limits refer to the maximum amount your policy will pay for a covered loss, while deductibles are the amount you’ll need to pay out-of-pocket before your coverage kicks in. For instance, if your collision coverage has a $500 deductible and you’re in an accident that causes $3,000 in damage, you’ll pay $500, and your insurer will cover the remaining $2,500.

Read also:Chase Koch Accident What Happened And Why It Matters

Step 3: Cross-Check with Your Needs

Finally, cross-check your coverage codes with your driving habits, vehicle value, and financial situation. If you frequently drive in high-traffic areas, you might want to ensure you have sufficient bodily injury and property damage liability coverage. On the other hand, if your vehicle is older, you might consider dropping collision or comprehensive coverage to save on premiums.

Common State Farm Auto Coverage Codes Explained

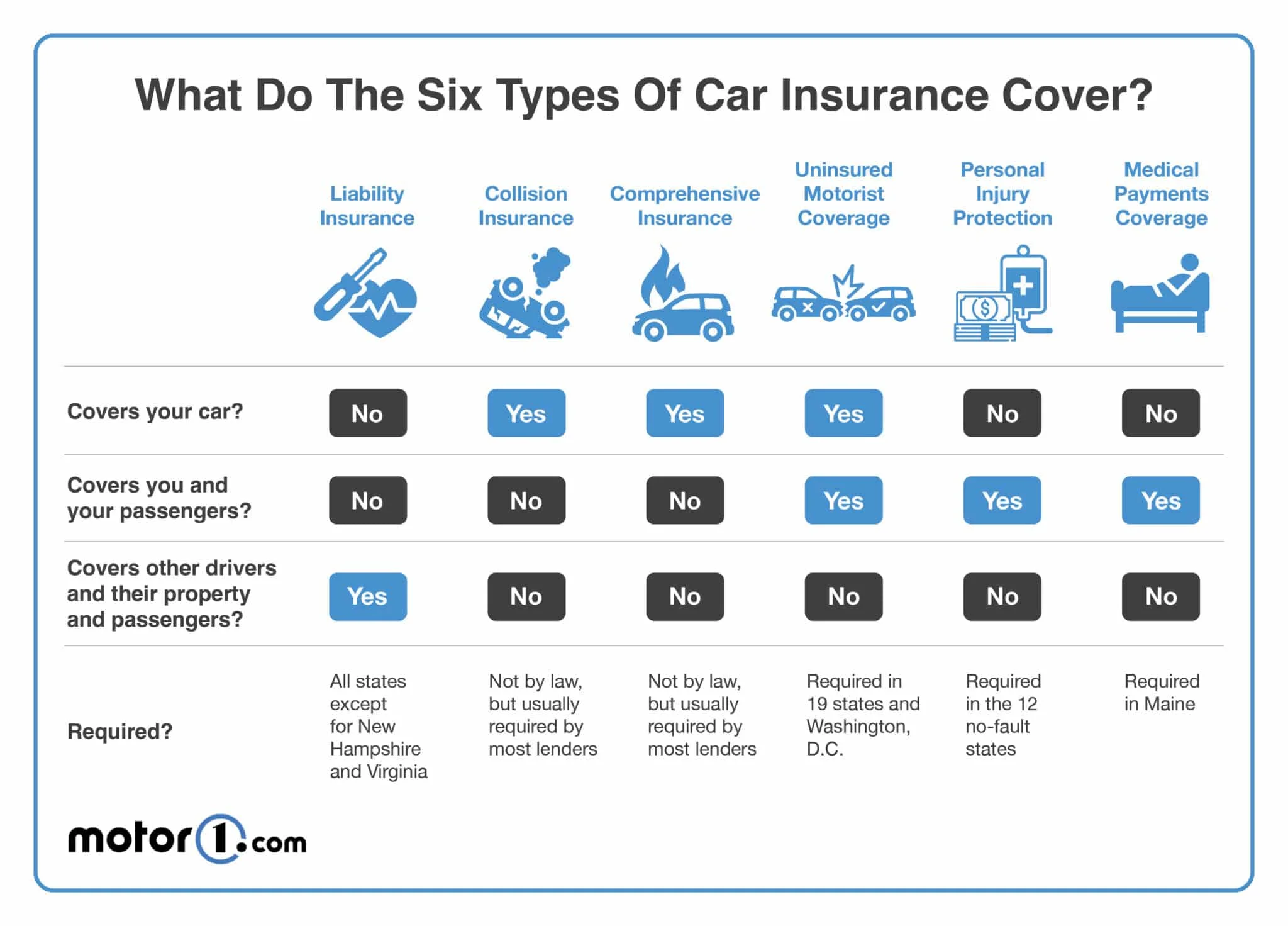

While State Farm auto coverage codes may vary depending on your policy, some codes are more common than others. Understanding these can help you make sense of your policy and ensure you have the right coverage for your needs. Below, we’ll explore some of the most frequently encountered codes and what they mean.

What Does BI-100/300 Mean?

BI-100/300 is one of the most common codes you’ll encounter, representing bodily injury liability coverage with limits of $100,000 per person and $300,000 per accident. This means that if you’re at fault in an accident, your policy will cover up to $100,000 in medical expenses for each injured person, with a maximum of $300,000 for all injured parties combined. Bodily injury liability is a mandatory coverage in most states, making this code a staple in most policies.

What Does PD-50 Mean?

PD-50 refers to property damage liability coverage with a $50,000 limit. This coverage pays for damage you cause to someone else’s property, such as their vehicle or a fence. While $50,000 might seem like a substantial amount, it’s important to note that repair costs can quickly add up, especially in accidents involving high-value vehicles. If you frequently drive in urban areas or have a history of accidents, you might consider increasing this limit to ensure adequate protection.

Other Common Codes

- COLL-500: Collision coverage with a $500 deductible. This pays for damage to your vehicle in an accident, regardless of fault.

- COMP-100: Comprehensive coverage with a $100 deductible. This covers non-collision-related incidents like theft, vandalism, or natural disasters.

- UM-25: Uninsured motorist coverage with a $25,000 limit. This protects you if you’re in an accident with a driver who doesn’t have insurance.

Are You Fully Covered? Assessing Your State Farm Policy

Now that you understand the basics of State Farm auto coverage codes, it’s time to assess whether your policy provides adequate protection. Many drivers assume their policy covers everything, only to discover gaps in coverage when they need it most. Here’s how to evaluate your policy and ensure you’re fully covered.

Do You Have Enough Liability Coverage?

Liability coverage is the foundation of any auto insurance policy, but many drivers underestimate how much they need. If you’re at fault in a serious accident, the costs can quickly exceed your policy limits, leaving you personally liable for the remainder. To determine if your liability coverage is sufficient, consider factors like your income, assets, and driving habits. If you have significant assets or frequently drive in high-traffic areas, increasing your limits might be a wise investment.

Is Your Vehicle Adequately Protected?

If you own a newer or high-value vehicle, collision and comprehensive coverage are essential. These coverages protect your car from damage caused by accidents, theft, vandalism, and natural disasters. However, if your vehicle is older and has depreciated significantly, you might consider dropping these coverages to save on premiums. To make an informed decision, compare the cost of your annual premium to the current value of your vehicle.

Customizing Your Coverage: What Options Are Available?

State Farm offers a variety of optional coverages that can be added to your policy to enhance your protection. These options allow you to tailor your policy to your unique needs and circumstances. Below are some popular add-ons and how they can benefit you.

Roadside Assistance

Roadside assistance provides peace of mind in case of emergencies like flat tires, dead batteries, or lockouts. This coverage is typically inexpensive and can save you significant time and hassle.

Rental Reimbursement

If your vehicle is in the shop after an accident, rental reimbursement coverage pays for a temporary replacement vehicle. This can be especially valuable if you rely on your car for daily commuting or work-related travel.

How to File a Claim Using State Farm Auto Coverage Codes?

Filing a claim with State Farm is a straightforward process, but understanding your coverage codes can make it even smoother. When you contact your agent or claims adjuster, having your codes handy will help them quickly identify the applicable coverage and process your claim efficiently.

Frequently Asked Questions About State Farm Auto Coverage Codes

What Happens If I Don’t Understand My Coverage Codes?

If you’re unsure about your coverage codes, don’t hesitate to contact your State Farm agent. They can explain each code and help you make adjustments if needed.

Can I Change My Coverage Codes Mid-Policy?

Yes, you can adjust your coverage codes at any time by contacting your agent. However, changes may result in a new premium calculation.

Are State Farm Auto Coverage Codes Standard Across All States?

No, coverage codes may vary depending on state regulations and available options. Always review your policy for state-specific details.

Conclusion: Navigating State Farm Auto Coverage Codes with Confidence

Understanding State Farm auto coverage codes is an essential step in ensuring you have the right protection for your vehicle and peace of mind on the road. By familiarizing yourself with these codes, you can make informed decisions about your policy, avoid surprises during claims, and customize your coverage to suit your needs. Whether you’re a new policyholder or a seasoned driver, taking the time to decode your policy is a worthwhile investment in your financial security.

For more information on auto insurance, you can visit State Farm’s official website.