Have you ever wondered if your Experian Boost score could make a difference when applying for a loan? This innovative credit-scoring tool is designed to help individuals improve their credit profiles by incorporating everyday bill payments, such as utilities and streaming services, into their credit reports. But here’s the million-dollar question: will lenders use my Experian Boost score when assessing my financial reliability? With the growing emphasis on alternative credit data, many borrowers are curious about how this tool fits into the lending ecosystem. Experian Boost offers a unique opportunity to showcase your financial responsibility beyond traditional credit metrics, but its adoption by lenders varies depending on the institution and loan type.

While Experian Boost has gained popularity among consumers, its role in the lending process is still evolving. Lenders typically rely on FICO scores or VantageScores for credit evaluations, but some are beginning to recognize the value of alternative data like Experian Boost. This tool can be particularly beneficial for individuals with thin credit files or those looking to build their credit from scratch. By including positive payment history from non-traditional sources, Experian Boost provides a more holistic view of a borrower’s financial behavior. However, understanding whether lenders will adopt this score requires a deeper dive into the nuances of credit scoring and lending practices.

For borrowers, the potential impact of Experian Boost on loan approvals is significant. It’s not just about improving your credit score—it’s about demonstrating financial responsibility in a way that traditional credit reports may not fully capture. As more lenders explore the use of alternative credit data, understanding how Experian Boost works and its relevance in the lending process becomes crucial. In this article, we’ll explore the ins and outs of Experian Boost, its acceptance among lenders, and what it means for your financial future. Whether you’re applying for a mortgage, auto loan, or personal loan, this guide will help you navigate the role of Experian Boost in credit evaluations.

Read also:Who Is Saud From Jules And Saud Discover The Real Name And Journey

Table of Contents

- What is Experian Boost and How Does It Work?

- Will Lenders Use My Experian Boost Score?

- Which Types of Loans Are Impacted by Experian Boost?

- How Can I Improve My Experian Boost Score?

- Is Experian Boost Worth It for My Credit Profile?

- What Are the Alternatives to Experian Boost?

- What Are the Common Misconceptions About Experian Boost?

- Frequently Asked Questions About Experian Boost

What is Experian Boost and How Does It Work?

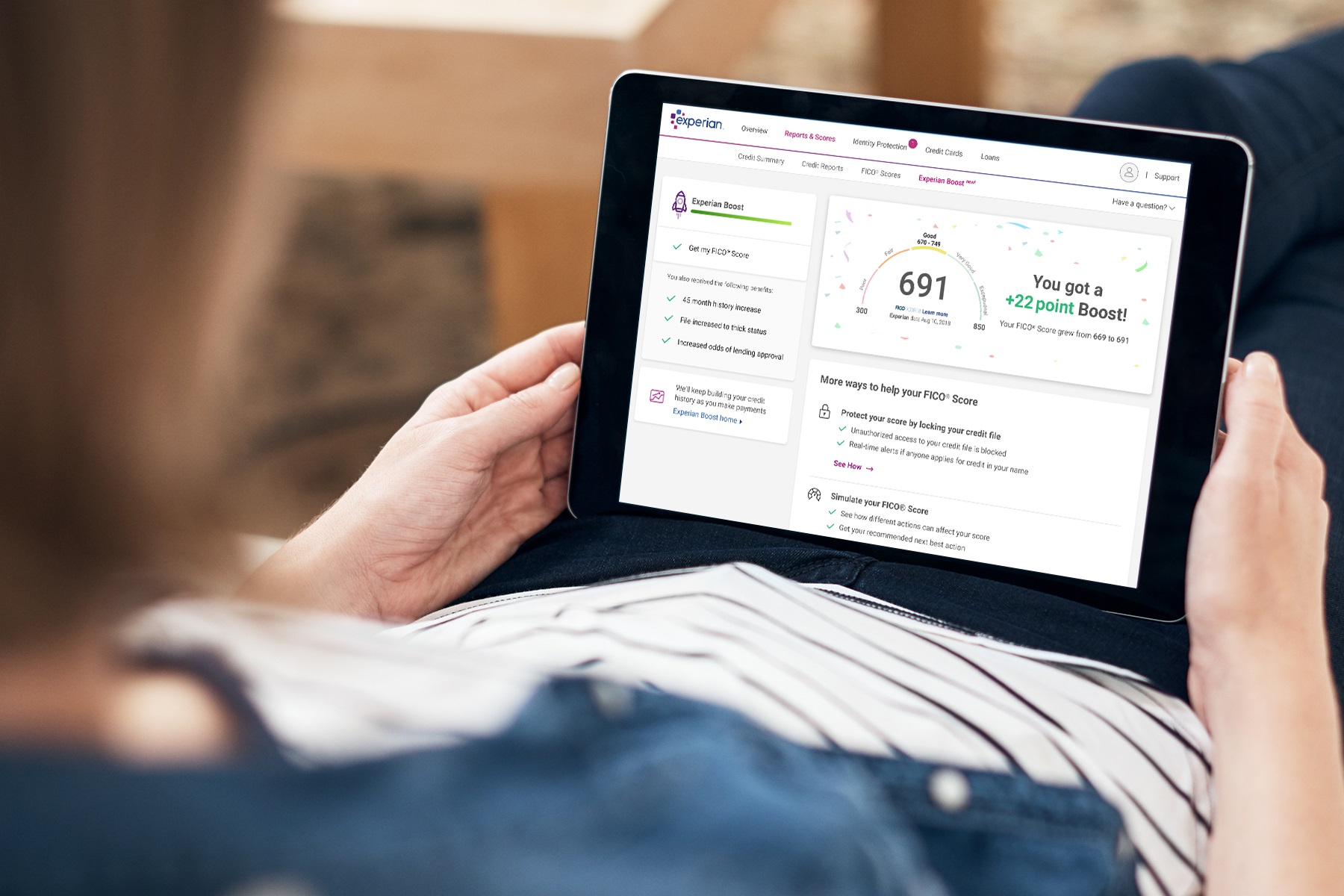

Experian Boost is a free service offered by Experian, one of the three major credit bureaus in the United States. It allows consumers to enhance their credit scores by incorporating positive payment history from non-traditional sources, such as utility bills, phone bills, and streaming service subscriptions. This service is particularly beneficial for individuals with limited credit history or those looking to improve their credit scores quickly. By linking your bank accounts to Experian Boost, the tool scans for eligible payments and adds them to your credit report, potentially increasing your FICO score.

How Does Experian Boost Work?

The process of using Experian Boost is straightforward and user-friendly. First, you’ll need to create a free account on Experian’s website and link your bank accounts. Once connected, Experian will analyze your transaction history to identify qualifying payments. These payments are then added to your Experian credit report, and your credit score is recalculated to reflect the new data. The entire process typically takes just a few minutes, and users often see an immediate improvement in their credit scores.

Key Benefits of Experian Boost

- Helps individuals with thin credit files build their credit history.

- Provides a more comprehensive view of financial responsibility.

- Can lead to higher credit scores, improving loan eligibility.

- Free to use, with no hidden fees or charges.

Will Lenders Use My Experian Boost Score?

One of the most common questions borrowers ask is, “Will lenders use my Experian Boost score?” The short answer is that it depends on the lender and the type of loan you’re applying for. While Experian Boost is a powerful tool for improving your credit profile, not all lenders take it into account during the underwriting process. Traditional lenders, such as banks and credit unions, often rely on FICO scores or VantageScores, which may not include the data from Experian Boost. However, some forward-thinking lenders are beginning to recognize the value of alternative credit data in assessing a borrower’s financial behavior.

Which Lenders Accept Experian Boost?

Several online lenders and fintech companies are more likely to consider Experian Boost scores because they are often more flexible in their underwriting processes. These lenders understand that traditional credit scores don’t always paint a complete picture of a borrower’s financial responsibility. By incorporating alternative data, they can make more informed lending decisions. For example, some personal loan providers and credit card issuers now factor in Experian Boost scores to evaluate applicants with limited credit histories.

Why Don’t All Lenders Use Experian Boost?

- Many lenders rely on standardized credit scoring models like FICO, which don’t include Experian Boost data.

- Some financial institutions are hesitant to adopt new scoring methods due to regulatory concerns.

- Traditional lenders may not have the infrastructure to integrate alternative credit data into their systems.

Which Types of Loans Are Impacted by Experian Boost?

Experian Boost can have varying effects depending on the type of loan you’re applying for. While it’s not universally accepted, certain loan products are more likely to benefit from the inclusion of alternative credit data. For instance, personal loans and credit cards are often more flexible in their credit evaluation processes, making them more likely to consider Experian Boost scores. On the other hand, mortgage lenders and auto loan providers typically adhere to stricter guidelines and may not take Experian Boost into account.

Personal Loans and Credit Cards

Personal loans and credit cards are among the most Experian Boost-friendly loan products. Many online lenders and credit card issuers are eager to attract borrowers with thin credit files or limited credit histories. By incorporating Experian Boost data, these lenders can offer more competitive terms and approval rates to applicants who might otherwise struggle to qualify.

Read also:Who Is Shane Barakan Discovering The Life And Achievements Of Shane Barakan

Why Experian Boost Matters for These Loans

- Helps borrowers with limited credit history access credit products.

- Increases approval odds for individuals with low traditional credit scores.

- Encourages lenders to offer better interest rates and terms.

How Can I Improve My Experian Boost Score?

If you’re wondering how to maximize the benefits of Experian Boost, there are several strategies you can implement. The key is to ensure that your payment history reflects positive financial behavior. This includes consistently paying your utility bills, phone bills, and streaming service subscriptions on time. By maintaining a strong track record of timely payments, you can significantly enhance your Experian Boost score and, by extension, your overall credit profile.

Steps to Improve Your Experian Boost Score

- Link all eligible bank accounts to Experian Boost to capture as much payment data as possible.

- Ensure that your bills are paid on time, as late payments won’t be included in the boost calculation.

- Regularly review your credit report to verify that all qualifying payments are accurately reflected.

Additional Tips for Success

- Avoid missing payments, as they can negatively impact your credit score.

- Use automatic bill payments to ensure consistency in your payment history.

- Monitor your credit score regularly to track the impact of Experian Boost.

Is Experian Boost Worth It for My Credit Profile?

For many borrowers, Experian Boost is a valuable tool for improving their credit scores. However, it’s essential to evaluate whether it’s the right fit for your financial situation. Is Experian Boost worth it for my credit profile? This question depends on factors such as your current credit score, payment history, and financial goals. If you have a thin credit file or limited credit history, Experian Boost can provide a significant boost to your score by incorporating alternative data. On the other hand, if you already have a strong credit profile, the impact may be less pronounced.

When Experian Boost Is Most Beneficial

Experian Boost is particularly advantageous for individuals who fall into the following categories:

- Borrowers with no or limited credit history.

- Individuals looking to rebuild their credit after financial setbacks.

- Consumers seeking to qualify for better loan terms and interest rates.

Potential Drawbacks to Consider

- Not all lenders recognize Experian Boost scores, limiting its impact on certain loan applications.

- The tool only works with Experian credit reports, so it won’t affect scores from other bureaus.

- It requires linking bank accounts, which some users may find concerning from a privacy standpoint.

What Are the Alternatives to Experian Boost?

If Experian Boost doesn’t align with your financial needs, there are other options available to improve your credit profile. These alternatives focus on building credit through responsible financial behavior and leveraging tools that cater to different credit-building strategies. What are the alternatives to Experian Boost? Understanding these options can help you make an informed decision about which path is best for your credit journey.

Secured Credit Cards

Secured credit cards are an excellent alternative for individuals looking to build or rebuild their credit. These cards require a security deposit, which serves as your credit limit. By using the card responsibly and paying off the balance each month, you can establish a positive payment history and improve your credit score over time.

Other Alternatives to Explore

- Credit-builder loans, which are designed to help individuals build credit from scratch.

- Authorized user status on someone else’s credit card account to piggyback on their positive credit history.

- Alternative credit reporting services that incorporate rent and utility payments into your credit profile.

What Are the Common Misconceptions About Experian Boost?

Despite its growing popularity, there are several misconceptions about Experian Boost that can lead to confusion among consumers. One common myth is that Experian Boost will automatically improve your credit score by a significant margin. While it can provide a boost, the actual impact varies depending on your existing credit profile and payment history. Another misconception is that all lenders will recognize and use your Experian Boost score, which, as we’ve discussed, is not the case.

Debunking the Myths

Let’s address some of the most prevalent misconceptions about Experian Boost:

- Myth: Experian Boost replaces traditional credit scores.

Reality: It supplements your credit report but doesn’t replace FICO or VantageScores. - Myth: It impacts all three credit bureaus.

Reality: Experian Boost only affects your Experian credit report. - Myth: It’s a quick fix for poor credit.

Reality: It works best for individuals with positive payment histories but limited credit files.

Why These Misconceptions Matter

Understanding the realities of Experian Boost can help you set realistic expectations and avoid disappointment. By dispelling these myths, you can make informed decisions about how to use the tool effectively and maximize its benefits.

Frequently Asked Questions About Experian Boost

Does Experian Boost Affect My FICO Score?

Yes, Experian Boost can affect your FICO score if your lender