With constantly evolving tax laws and regulations, it's crucial to stay informed about the latest changes that could impact your tax obligations. From determining your filing status to maximizing deductions, this guide will walk you through everything you need to know about NYS income tax. For many individuals, the process of filing NYS income tax can feel overwhelming, especially when juggling federal tax obligations at the same time. However, with the right knowledge and tools, you can simplify the process and avoid costly mistakes.

Knowing how to calculate your tax liability, claim eligible credits, and file your return accurately can save you both time and money. This article will provide you with actionable insights and expert advice to help you navigate the intricacies of NYS income tax with confidence.

Whether you're a first-time filer or a seasoned taxpayer, staying informed about NYS income tax is key to ensuring you meet your obligations and take advantage of any available benefits. In the following sections, we'll explore the various aspects of NYS income tax, including how it works, who needs to file, and what deductions and credits you may be eligible for. By the end of this guide, you'll have a comprehensive understanding of NYS income tax and be better equipped to manage your tax responsibilities effectively.

Read also:The Timeless Legacy Of Chubby Checker King Of The Twist

Table of Contents

- What is NYS Income Tax and How Does It Work?

- Who Needs to File NYS Income Tax?

- How to Calculate Your NYS Income Tax Liability?

- What Deductions and Credits Are Available for NYS Taxpayers?

- What Is the Process for Filing NYS Income Tax?

- What Are the Most Common Mistakes to Avoid When Filing NYS Income Tax?

- How Can You Plan for NYS Income Tax Throughout the Year?

- Frequently Asked Questions About NYS Income Tax

What is NYS Income Tax and How Does It Work?

New York State income tax is a tax levied on the income earned by individuals, businesses, and other entities within the state. It operates on a progressive tax system, meaning that the tax rate increases as your income rises. The current NYS income tax rates range from 4% to 8.82%, depending on your filing status and taxable income. This system ensures that individuals with higher incomes contribute a larger share of their earnings to state revenue.

One of the key features of NYS income tax is its alignment with federal tax laws. While New York has its own set of rules and regulations, many aspects of the tax code mirror federal guidelines. For example, taxpayers can often use their federal adjusted gross income (AGI) as a starting point for calculating their NYS taxable income. However, there are important differences, such as additional deductions and credits available at the state level that are not offered federally.

Understanding how NYS income tax works is essential for anyone earning income in the state. Whether you're a full-time resident, a part-year resident, or a non-resident earning income from New York sources, you may be required to file a state tax return. Factors such as your residency status, income level, and sources of income will determine your tax obligations. By familiarizing yourself with the basics of NYS income tax, you can ensure compliance and avoid potential penalties.

Who Needs to File NYS Income Tax?

Determining whether you need to file NYS income tax depends on several factors, including your residency status, income level, and the type of income you earn. Full-time residents of New York State are generally required to file a return if their gross income exceeds the filing threshold for their filing status. For example, single filers with a gross income of $8,500 or more must file, while married couples filing jointly must file if their combined income exceeds $17,150.

Part-year residents and non-residents also have specific filing requirements. If you lived in New York for only part of the year, you may need to file a return if your income from New York sources meets or exceeds the filing threshold. Similarly, non-residents who earn income from New York sources, such as wages, business income, or rental income, may be required to file. It's important to note that certain types of income, such as retirement income and Social Security benefits, may be exempt from NYS income tax.

To determine your filing obligations, consider the following factors:

Read also:9x Hub Movies Exclusive Adult Content

- Your residency status (full-time resident, part-year resident, or non-resident).

- Your total gross income, including wages, self-employment income, and investment income.

- Whether you have income from New York sources, such as employment or rental property.

By understanding these requirements, you can ensure that you meet your obligations and avoid penalties for underpayment or late filing.

How to Calculate Your NYS Income Tax Liability?

Calculating your NYS income tax liability involves several steps, starting with determining your taxable income. This process begins with your federal adjusted gross income (AGI) and then makes adjustments for state-specific deductions and exemptions. For example, New York allows taxpayers to deduct certain expenses, such as student loan interest and contributions to a college savings plan, that may not be deductible on their federal return.

Once you've calculated your taxable income, you'll apply the appropriate tax rate based on your income bracket and filing status. New York's progressive tax system means that different portions of your income are taxed at different rates. For instance, the first $8,500 of taxable income for single filers is taxed at 4%, while income above $21,400 is taxed at higher rates. This tiered structure ensures that individuals with higher incomes pay a larger percentage of their earnings in taxes.

To simplify the calculation process, you can use tax preparation software or consult a tax professional. These tools can help you identify eligible deductions and credits, ensuring that you pay only what you owe. Additionally, understanding how to calculate your NYS income tax liability can help you plan for future tax years and avoid surprises when filing your return.

What Deductions and Credits Are Available for NYS Taxpayers?

New York State offers a variety of deductions and credits designed to reduce your tax liability and provide financial relief. Common deductions include those for mortgage interest, property taxes, and contributions to retirement accounts. These deductions lower your taxable income, which in turn reduces the amount of tax you owe. For example, if you itemize your deductions, you can deduct up to $10,000 in state and local taxes (SALT) from your federal taxable income.

In addition to deductions, NYS taxpayers can take advantage of several tax credits. The Earned Income Tax Credit (EITC), for instance, provides financial assistance to low- and moderate-income workers. Similarly, the Child and Dependent Care Credit helps offset the costs of childcare expenses for working parents. These credits directly reduce your tax liability, potentially resulting in a refund if the credit exceeds the amount of tax you owe.

Other notable credits include the College Tuition Credit, which helps offset the cost of higher education, and the Real Property Tax Credit, which provides relief for homeowners. By understanding the deductions and credits available to you, you can maximize your tax savings and ensure you're taking full advantage of the benefits offered by NYS income tax laws.

What Is the Process for Filing NYS Income Tax?

Filing your NYS income tax return involves several steps, from gathering the necessary documents to submitting your return. The process can be completed either online or through paper filing, depending on your preference and circumstances. Regardless of the method you choose, it's important to ensure that your return is accurate and submitted by the deadline to avoid penalties.

How to File NYS Income Tax Online?

Filing your NYS income tax online is a convenient and efficient option for many taxpayers. The New York State Department of Taxation and Finance offers an e-filing system called "Web File," which allows you to submit your return electronically. To use this service, you'll need to create an account and provide your personal information, including your Social Security number and filing status.

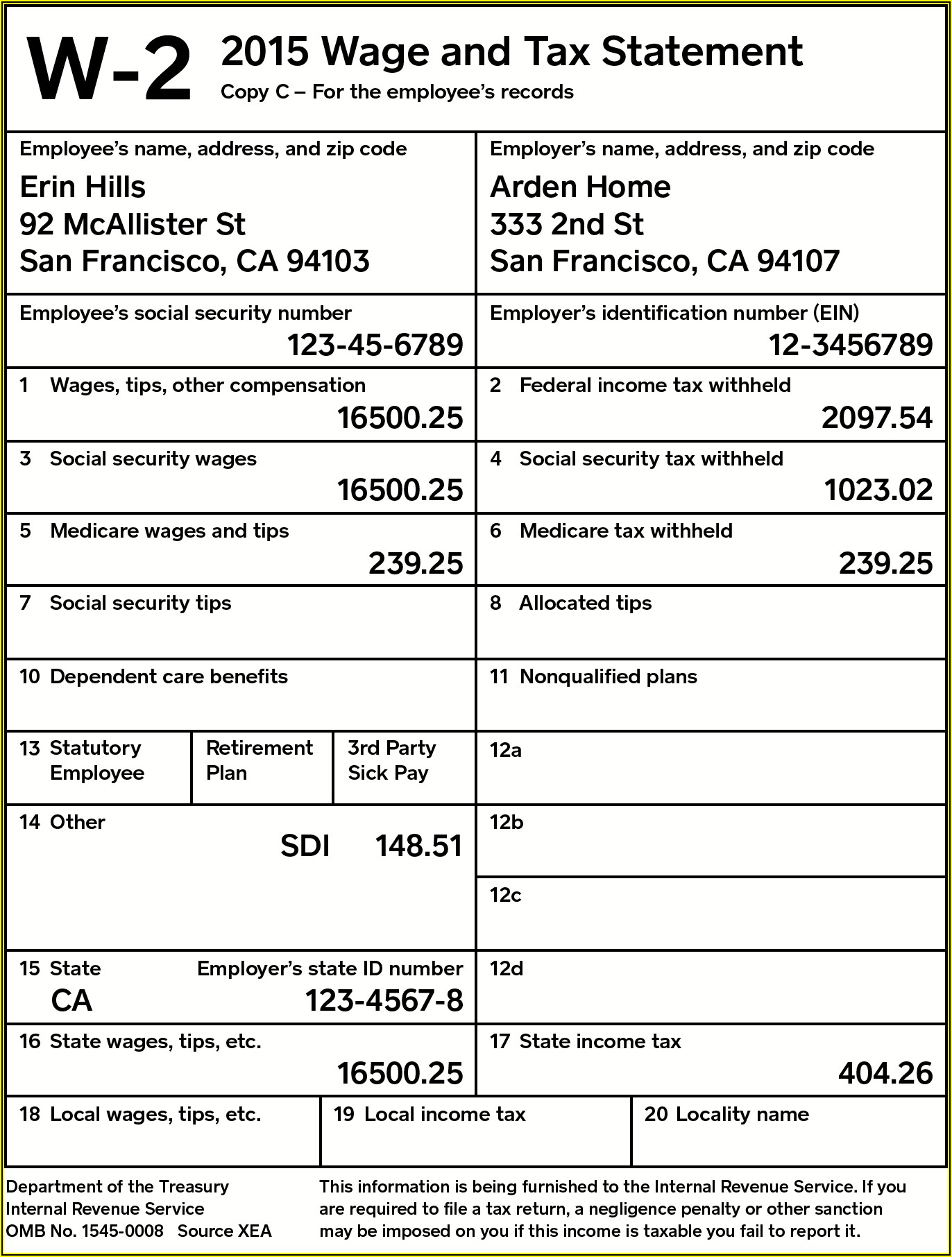

Once you've entered your information, the system will guide you through the process of completing your return. You can upload supporting documents, such as W-2s and 1099s, and the system will automatically calculate your tax liability. After reviewing your return for accuracy, you can submit it electronically and receive confirmation of receipt. Online filing is not only faster but also reduces the risk of errors compared to paper filing.

What Are the Steps for Paper Filing?

If you prefer to file your NYS income tax return by mail, you'll need to complete Form IT-201 (for full-year residents) or Form IT-203 (for non-residents and part-year residents). Begin by gathering all necessary documents, including your W-2s, 1099s, and any other records of income and deductions. Fill out the appropriate form, ensuring that all information is accurate and legible.

Once your form is complete, attach any required supporting documents and mail it to the address specified in the instructions. It's important to keep a copy of your return and all supporting documents for your records. Paper filing may take longer to process than electronic filing, so be sure to submit your return well before the deadline to avoid late penalties.

What Are the Most Common Mistakes to Avoid When Filing NYS Income Tax?

Filing your NYS income tax return can be a straightforward process if you take the time to avoid common mistakes. One of the most frequent errors is failing to report all sources of income. Whether it's a side gig, freelance work, or investment income, every dollar you earn must be reported to avoid penalties and interest. Double-checking your W-2s and 1099s against your records can help ensure accuracy.

Another common mistake is overlooking eligible deductions and credits. Many taxpayers miss out on valuable tax breaks simply because they're unaware of them or fail to claim them properly. For example, homeowners often forget to deduct mortgage interest or property taxes, while parents may overlook the Child and Dependent Care Credit. Taking the time to research available deductions and credits can significantly reduce your tax liability.

Finally, submitting your return late or with errors can lead to unnecessary penalties and delays. Whether you're filing online or by mail, ensure that your return is complete and accurate before submission. If you're unsure about any aspect of your return, consider consulting a tax professional for guidance. By avoiding these common mistakes, you can ensure a smooth and stress-free filing process.

How Can You Plan for NYS Income Tax Throughout the Year?

Effective tax planning is essential for managing your NYS income tax obligations and maximizing your financial resources. One of the best strategies is to set aside a portion of your income throughout the year to cover your tax liability. This can be done through automatic transfers to a dedicated savings account or by adjusting your withholding allowances to ensure you're not underpaying or overpaying.

Another important aspect of tax planning is staying informed about changes to NYS tax laws. Tax regulations can change frequently, and staying up-to-date can help you take advantage of new deductions, credits, or exemptions. Subscribing to updates from the New York State Department of Taxation and Finance or consulting a tax professional can keep you informed about any changes that may impact your tax situation.

Finally, consider leveraging tax-advantaged accounts, such as IRAs or 529 plans, to reduce your taxable income. Contributions to these accounts are often deductible or tax-free, providing a valuable way to save for the future while minimizing your current tax liability. By incorporating these strategies into your financial planning, you can stay ahead of your NYS income tax obligations and make the most of your hard-earned money.

Frequently Asked Questions About NYS Income Tax

What Is the Deadline for Filing NYS Income Tax?

The deadline for filing NYS income tax is typically April 15th, aligning with the federal tax filing deadline.