Chase Mortgage has become one of the most trusted names in the world of home financing, offering a variety of loan options to suit different needs. Whether you're a first-time homebuyer or looking to refinance, Chase Mortgage provides a range of services designed to make the process easier and more accessible. With decades of experience in the mortgage industry, Chase Mortgage has built a reputation for reliability and customer-focused solutions. The company’s commitment to innovation and personalized service has helped millions of homeowners achieve their dreams of owning a home. As part of JPMorgan Chase, one of the largest financial institutions in the world, Chase Mortgage offers the resources and expertise that borrowers can trust.

For many, securing a mortgage is one of the most significant financial decisions they will ever make. Chase Mortgage simplifies this process by offering tools like online calculators, pre-qualification options, and educational resources to help borrowers make informed decisions. From fixed-rate loans to adjustable-rate mortgages, Chase Mortgage ensures that its customers have access to a variety of loan products tailored to their financial goals. Additionally, the company’s customer service team is available to guide borrowers through every step of the process, ensuring a smooth and stress-free experience.

As the housing market continues to evolve, Chase Mortgage remains at the forefront of innovation, adapting to changing economic conditions and customer needs. With a focus on transparency and affordability, Chase Mortgage strives to provide competitive rates and flexible terms. Whether you’re purchasing your first home, refinancing an existing mortgage, or exploring investment property options, Chase Mortgage is equipped to meet your needs. In this article, we’ll explore everything you need to know about Chase Mortgage, from its offerings and benefits to tips for navigating the mortgage process successfully.

Read also:Understanding Fox News Salaries A Comprehensive Guide

Table of Contents

- What is Chase Mortgage and How Does It Work?

- Types of Mortgage Loans Offered by Chase

- How to Qualify for a Chase Mortgage?

- Benefits of Choosing Chase Mortgage for Your Home Loan

- What Are the Common Challenges in Getting a Chase Mortgage?

- How to Navigate the Chase Mortgage Application Process?

- Tips for Successfully Managing Your Chase Mortgage

- Frequently Asked Questions About Chase Mortgage

What is Chase Mortgage and How Does It Work?

At its core, a mortgage is a loan specifically designed to help individuals purchase real estate. Chase Mortgage operates as a division of JPMorgan Chase, offering home financing solutions to borrowers across the United States. When you take out a mortgage with Chase, you’re essentially borrowing money to buy a home, with the property itself serving as collateral for the loan. This means that if you fail to repay the loan as agreed, Chase has the right to foreclose on the property.

Chase Mortgage works by providing borrowers with various loan options tailored to their financial situations and goals. These loans typically come with either fixed or adjustable interest rates. A fixed-rate mortgage means your interest rate remains the same throughout the life of the loan, providing predictability in monthly payments. On the other hand, an adjustable-rate mortgage (ARM) has an interest rate that can fluctuate over time based on market conditions, which may result in lower initial payments but carries the risk of increasing later.

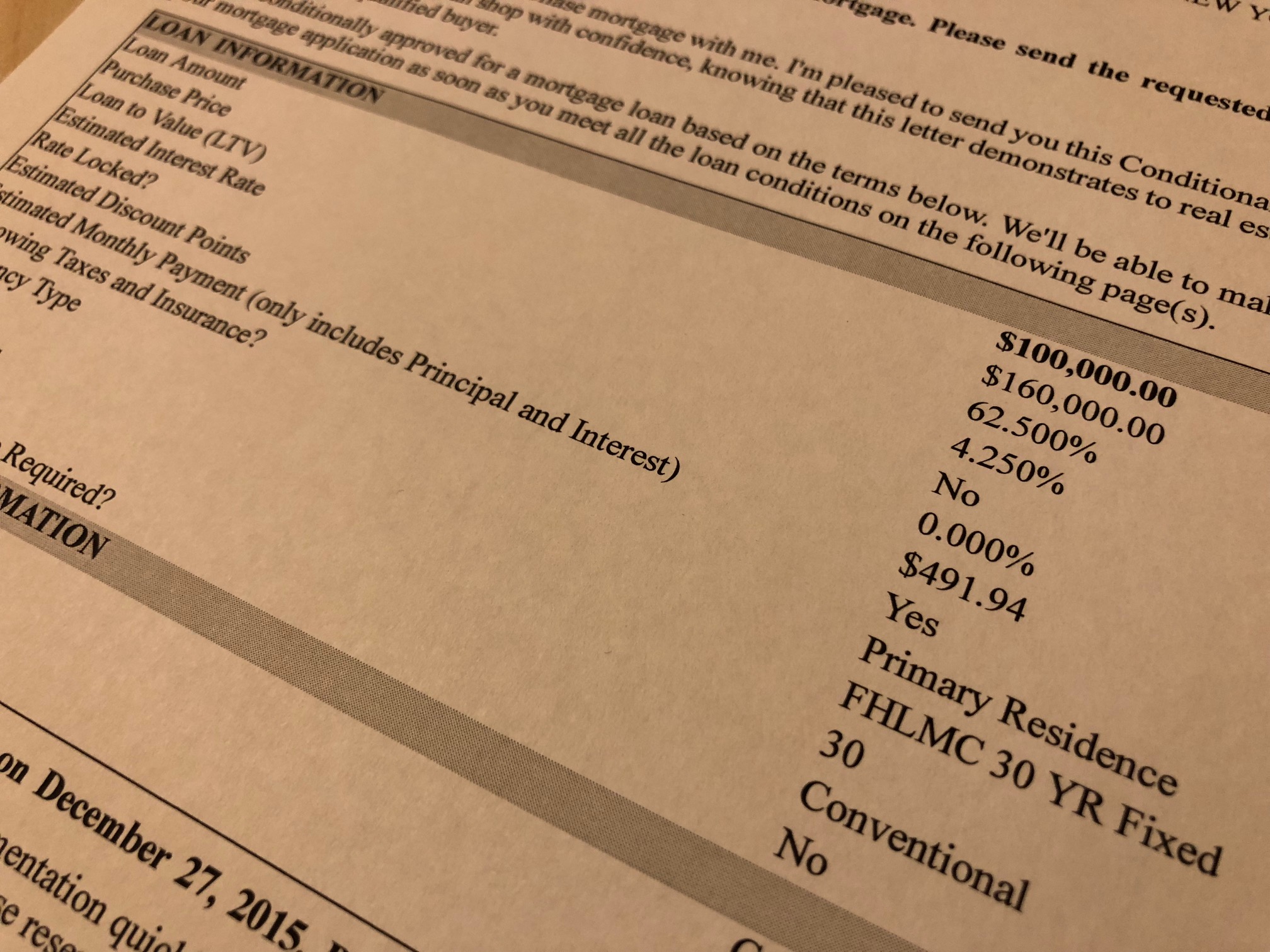

Once you apply for a Chase Mortgage, the company evaluates your financial profile, including your credit score, income, and existing debts, to determine your eligibility and loan terms. After approval, you’ll receive a loan estimate outlining the terms, interest rate, and closing costs. Upon accepting the terms, you’ll proceed to closing, where you’ll sign the necessary documents and officially take ownership of the property. Throughout the life of the loan, Chase Mortgage offers tools and resources to help you manage your payments and stay on track.

Types of Mortgage Loans Offered by Chase

Fixed-Rate Mortgages: Stability and Predictability

Fixed-rate mortgages are one of the most popular options offered by Chase Mortgage. These loans are ideal for borrowers who prefer stability and predictability in their monthly payments. With a fixed-rate mortgage, the interest rate remains constant throughout the life of the loan, typically 15 or 30 years. This makes it easier for homeowners to budget and plan for the future without worrying about fluctuating payments.

Adjustable-Rate Mortgages (ARMs): Flexibility with Potential Risks

Chase Mortgage also offers adjustable-rate mortgages (ARMs), which come with an interest rate that can change periodically based on market conditions. ARMs typically start with a lower introductory rate for a set period, such as 5, 7, or 10 years, after which the rate adjusts annually. While ARMs can be beneficial for borrowers who plan to sell or refinance before the rate adjusts, they carry the risk of higher payments in the future.

Government-Backed Loans: FHA, VA, and USDA Options

For borrowers who may not qualify for conventional loans, Chase Mortgage provides government-backed loan options. These include Federal Housing Administration (FHA) loans, which are ideal for first-time homebuyers with lower credit scores. Veterans Affairs (VA) loans are available to eligible military service members and veterans, offering competitive rates and no down payment requirements. Additionally, the U.S. Department of Agriculture (USDA) loans cater to rural homebuyers, providing affordable financing options with minimal down payments.

Read also:Pet Shop Boys A Deep Dive Into Their Legacy And Influence

Jumbo Loans: Financing for High-Value Properties

For those looking to purchase luxury homes or properties in high-cost areas, Chase Mortgage offers jumbo loans. These loans exceed the conforming loan limits set by the Federal Housing Finance Agency (FHFA) and are designed for borrowers with strong credit profiles and substantial financial resources. While jumbo loans typically require larger down payments and stricter qualification criteria, they provide the flexibility needed to finance high-value properties.

Refinancing Options: Lowering Your Payments or Tapping Equity

Chase Mortgage also provides refinancing options for homeowners looking to lower their interest rates, reduce monthly payments, or tap into their home equity. Rate-and-term refinancing allows borrowers to adjust the terms of their existing mortgage, while cash-out refinancing enables homeowners to access the equity in their homes for other financial needs, such as home improvements or debt consolidation.

How to Qualify for a Chase Mortgage?

Qualifying for a Chase Mortgage involves meeting specific financial and credit requirements to ensure you’re a reliable borrower. The process begins with a thorough evaluation of your financial profile, including your credit score, income, and debt-to-income ratio. A strong credit score is essential, as it demonstrates your ability to manage debt responsibly. While Chase Mortgage doesn’t publicly disclose its minimum credit score requirements, most conventional loans require a score of at least 620, while government-backed loans may accept lower scores.

In addition to your credit score, Chase Mortgage assesses your income and employment history to ensure you have a stable source of funds to repay the loan. Typically, lenders prefer borrowers with at least two years of consistent employment in the same field. Your debt-to-income ratio (DTI) is another critical factor, as it measures the percentage of your monthly income that goes toward paying debts. A DTI ratio below 43% is generally required, although lower ratios improve your chances of approval.

Other factors that influence your eligibility include your down payment amount and available assets. While Chase Mortgage offers low down payment options for certain loan programs, such as FHA loans, a larger down payment can reduce your monthly payments and eliminate the need for private mortgage insurance (PMI). Additionally, having savings or other liquid assets can strengthen your application by demonstrating financial stability. By preparing these documents and meeting the necessary criteria, you can increase your chances of qualifying for a Chase Mortgage.

Benefits of Choosing Chase Mortgage for Your Home Loan

Choosing Chase Mortgage for your home financing needs comes with a host of benefits that set it apart from other lenders. One of the most significant advantages is the company’s wide range of loan options, catering to diverse financial situations and goals. Whether you’re a first-time homebuyer, a veteran, or someone looking to purchase a luxury property, Chase Mortgage has a solution tailored to your needs. This flexibility ensures that you can find a loan product that aligns with your budget and long-term plans.

Another key benefit of Chase Mortgage is its commitment to customer service. The company provides a variety of tools and resources to simplify the mortgage process, including online calculators, pre-qualification tools, and educational materials. These resources empower borrowers to make informed decisions and feel confident throughout the application process. Additionally, Chase Mortgage’s customer service team is readily available to answer questions and guide you through each step, ensuring a seamless experience.

Chase Mortgage also offers competitive interest rates and flexible terms, helping borrowers save money over the life of their loans. For example, fixed-rate mortgages provide stability with predictable payments, while adjustable-rate mortgages offer lower initial rates for those planning to sell or refinance in the near future. Furthermore, Chase Mortgage’s online platform allows borrowers to manage their loans conveniently, from submitting applications to making payments. These advantages make Chase Mortgage a reliable and customer-focused choice for home financing.

What Are the Common Challenges in Getting a Chase Mortgage?

While Chase Mortgage offers a streamlined and customer-friendly process, there are still common challenges that borrowers may encounter. One of the most frequent hurdles is meeting the credit score requirements. A low credit score can significantly impact your ability to qualify for a mortgage or secure favorable terms. Borrowers with scores below the recommended threshold may face higher interest rates or be required to make a larger down payment to compensate for the increased risk.

Debt-to-Income Ratio: A Key Barrier for Many Borrowers

Another challenge is maintaining a manageable debt-to-income (DTI) ratio. Lenders like Chase Mortgage use this ratio to assess your ability to repay the loan, and a high DTI can signal financial instability. If your monthly debt obligations consume too much of your income, it may disqualify you from certain loan programs. Reducing existing debts or increasing your income before applying can help improve your DTI and increase your chances of approval.

Documentation Requirements: Navigating the Paperwork

The documentation process can also be a challenge for some borrowers. Chase Mortgage requires detailed financial records, including proof of income, tax returns, bank statements, and asset documentation. Gathering and organizing these documents can be time-consuming, especially for self-employed individuals or those with complex financial situations. Missing or incomplete paperwork can delay the application process, so it’s essential to prepare thoroughly in advance.

Market Conditions: How They Impact Mortgage Approval

Economic and housing market conditions can also pose challenges for borrowers. Rising interest rates, for example, can increase the cost of borrowing and make it harder to afford monthly payments. Similarly, fluctuations in home prices or stricter lending standards can affect your ability to secure a mortgage. Staying informed about market trends and working closely with a Chase Mortgage representative can help you navigate these challenges effectively.

How to Navigate the Chase Mortgage Application Process?

The Chase Mortgage application process may seem daunting at first, but with the right preparation, it can be a smooth and manageable experience. The first step is to gather all necessary documentation, including proof of income, tax returns, bank statements, and identification. Having these documents ready will streamline the process and help you avoid delays. Chase Mortgage also offers an online pre-qualification tool, which allows you to get an estimate of how much you can borrow based on your financial profile.

Step 1: Pre-Qualification and Loan Selection

Pre-qualification is a crucial first step in the Chase Mortgage application process. During this phase, you’ll provide basic financial information, such as your income, assets, and debts, to determine your eligibility for a loan. Once pre-qualified, you can explore the various loan options available and select the one that best suits your needs. Chase Mortgage representatives are available to guide you through this process and answer any questions you may have.

Step 2: Submitting Your Application

After selecting a loan program, you’ll need to submit a formal application. This involves providing detailed documentation to verify your financial information. Chase Mortgage’s online platform makes it easy to upload documents and track the status of your application. During this stage, a loan officer will review your application and may request additional information if needed.

Step 3: Underwriting and Closing

Once your application is submitted, it enters the underwriting phase, where Chase Mortgage evaluates your financial profile and the property you’re purchasing. This step ensures that you