Are you curious about what are the key stocks to watch in Boston's commuter rail sector? Look no further! The Boston commuter rail system plays a pivotal role in the region’s transportation network, serving millions of passengers annually. With increasing urbanization and growing demand for sustainable transit solutions, the sector has become a focal point for investors and policymakers alike. This article delves into the top-performing stocks, emerging trends, and investment opportunities in this dynamic industry, offering valuable insights for both seasoned investors and newcomers.

Boston's commuter rail system is not just about moving people—it's also about driving economic growth. The sector has witnessed significant developments over the past few years, with infrastructure upgrades, technological advancements, and sustainability initiatives reshaping its landscape. As these changes unfold, certain companies stand out as key players whose stocks are worth monitoring. Whether you're looking for long-term investments or short-term gains, understanding the financial health, market position, and growth potential of these companies is essential for making informed decisions.

In this comprehensive guide, we’ll explore everything from the major players shaping the sector to the innovative technologies driving its future. Along the way, we'll answer critical questions like: What are the key stocks to watch in Boston's commuter rail sector? How do infrastructure investments impact stock performance? And what role does sustainability play in shaping investment opportunities? By the end of this article, you'll have a clear roadmap to navigate the exciting world of commuter rail stocks.

Read also:Eden Eloise Holyfield The Rising Star Ndash Biography Achievements And Legacy

Table of Contents

- What Are the Major Players in Boston's Commuter Rail Sector?

- How Does Infrastructure Investment Impact Stock Performance?

- What Are the Key Stocks to Watch in Boston's Commuter Rail Sector?

- Emerging Technologies Transforming the Commuter Rail Industry

- Is Sustainability a Game-Changer for Commuter Rail Stocks?

- How Can Investors Evaluate Growth Potential in This Sector?

- What Are the Risks and Challenges in the Commuter Rail Sector?

- Frequently Asked Questions About Commuter Rail Stocks

What Are the Major Players in Boston's Commuter Rail Sector?

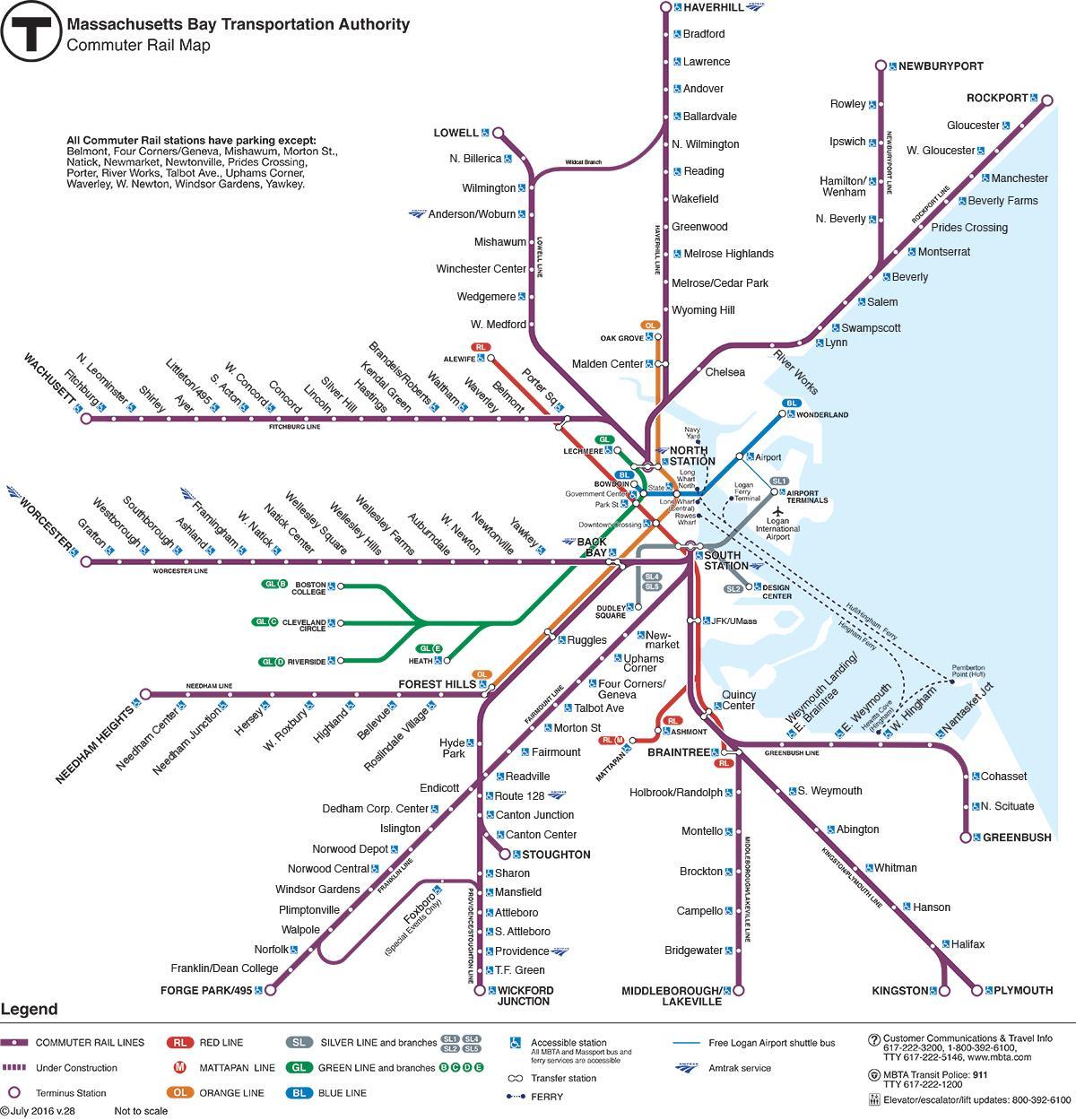

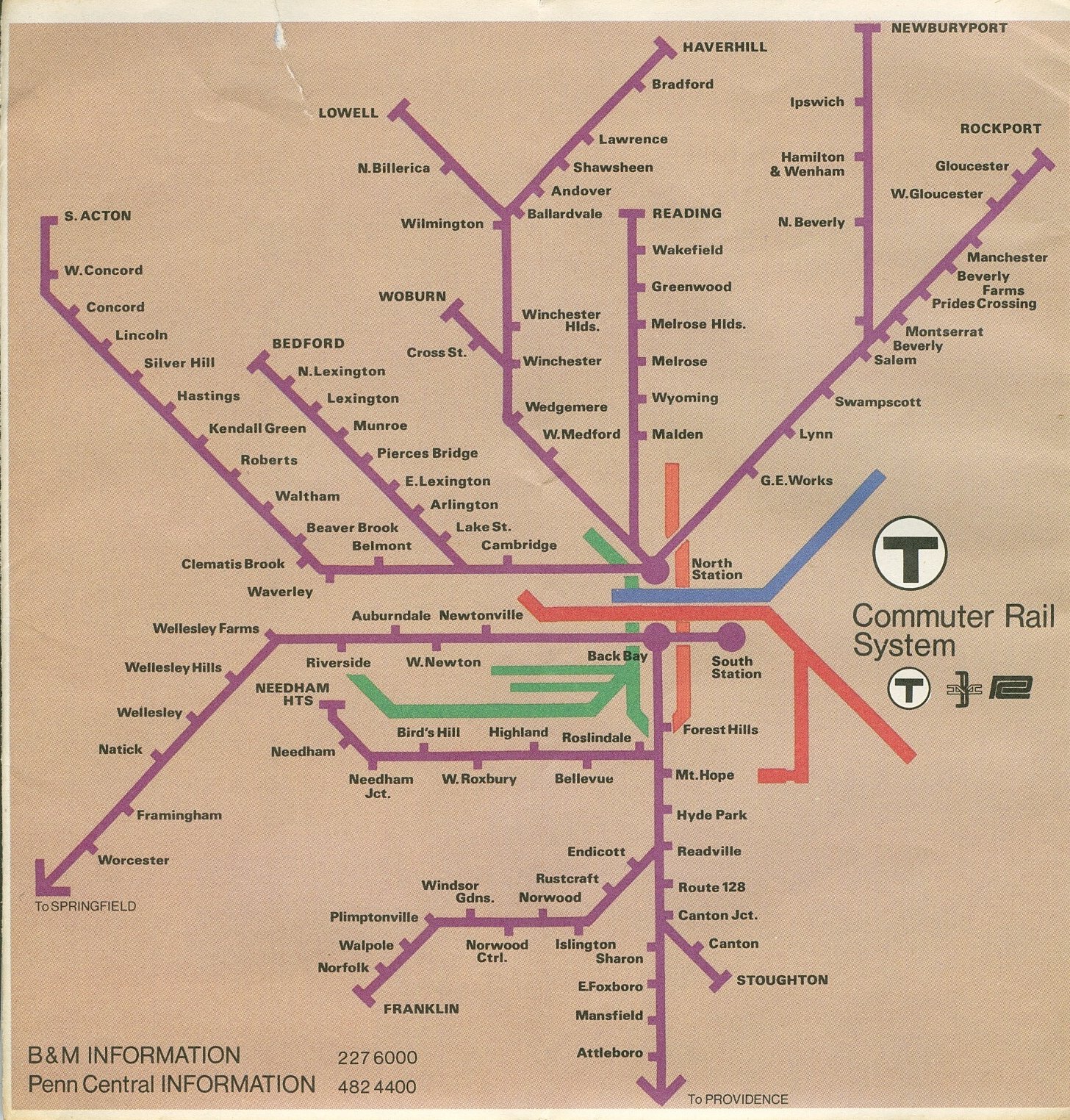

Boston's commuter rail system is supported by several key organizations and companies that ensure its smooth operation. The Massachusetts Bay Transportation Authority (MBTA), often referred to as the "T," is the primary entity responsible for managing the network. Alongside the MBTA, private contractors and infrastructure companies play a crucial role in maintaining and upgrading the system. These players collectively influence the performance of stocks tied to the commuter rail sector.

Among the major companies worth noting are those involved in rail manufacturing, maintenance, and technology integration. For instance, companies like Bombardier Transportation and Siemens Mobility are renowned for manufacturing state-of-the-art rail vehicles used in Boston's network. Their financial performance often reflects broader trends in the industry, making them attractive options for investors. Additionally, firms specializing in rail signaling systems, such as Thales Group, contribute to operational efficiency and safety, further solidifying their importance in the sector.

Understanding the market dynamics of these major players is essential for identifying promising stocks. Their partnerships with government agencies, technological innovations, and ability to adapt to changing commuter needs often serve as indicators of future growth potential. By keeping an eye on these companies, investors can gain insights into the health of Boston's commuter rail sector and make informed decisions.

How Does Infrastructure Investment Impact Stock Performance?

Infrastructure investment is a cornerstone of the commuter rail sector's growth, directly influencing stock performance. When governments allocate funds for rail projects, it often leads to increased revenue opportunities for companies involved in construction, maintenance, and technology implementation. For example, the Biden administration's recent infrastructure bill has earmarked billions for public transit systems, including commuter rail networks like Boston's. This influx of capital can create a ripple effect, boosting stock prices for companies in the supply chain.

Investors should also consider how infrastructure investments align with broader economic trends. For instance, urbanization and population growth in metropolitan areas like Boston drive demand for efficient transit solutions. Companies that position themselves as leaders in addressing these needs often see their stocks outperform the market. Additionally, infrastructure spending can lead to job creation and economic stimulation, further benefiting companies in the sector.

However, it's important to note that infrastructure projects often come with risks, such as delays, cost overruns, and regulatory hurdles. These factors can negatively impact stock performance if not managed effectively. To mitigate these risks, savvy investors focus on companies with a proven track record of executing large-scale projects and maintaining strong relationships with government entities. By understanding the interplay between infrastructure investment and stock performance, investors can better navigate this complex landscape.

Read also:Vijay Varma The Actors Journey

What Are the Key Stocks to Watch in Boston's Commuter Rail Sector?

When it comes to identifying what are the key stocks to watch in Boston's commuter rail sector, a few names consistently stand out. These companies are not only integral to the functioning of the rail network but also offer promising investment opportunities. For instance, CSX Corporation, a leading freight rail company, plays a vital role in transporting goods across the region, indirectly supporting the commuter rail ecosystem. Its stock has shown resilience and growth potential, making it a favorite among investors.

Another key player is Wabtec Corporation, a global leader in rail equipment, digital solutions, and services. Wabtec's innovative technologies, such as predictive maintenance systems and energy-efficient locomotives, align with the industry's push toward sustainability and efficiency. Investors often monitor Wabtec's stock due to its strong financials and strategic partnerships with major rail operators. Similarly, Jacobs Engineering Group, known for its expertise in infrastructure development, is another stock worth watching. The company's involvement in large-scale rail projects positions it as a key beneficiary of increased infrastructure spending.

Other notable mentions include AECOM, a premier infrastructure consulting firm, and Alstom, a French multinational company specializing in rail transport. Both companies have a significant presence in Boston's commuter rail sector and are poised to benefit from ongoing and future projects. By keeping an eye on these key stocks, investors can capitalize on the growth trajectory of Boston's commuter rail industry while diversifying their portfolios effectively.

Why Should Investors Focus on Sustainable Stocks in the Rail Sector?

Sustainability is no longer just a buzzword—it's a driving force behind investment decisions in the rail sector. As environmental concerns gain prominence, companies prioritizing green technologies and practices are attracting investor attention. For instance, firms developing electric or hybrid locomotives are seen as pioneers in reducing the carbon footprint of rail transport. This shift not only aligns with global sustainability goals but also enhances the long-term viability of these companies, making their stocks more attractive.

Investors should also consider how regulatory pressures influence stock performance. Governments worldwide are implementing stricter emissions standards, pushing rail companies to adopt cleaner technologies. Those failing to adapt risk facing penalties or losing market share, which can negatively impact their stock prices. On the flip side, companies leading the charge in sustainability often receive incentives, subsidies, and favorable public perception, all of which can boost their financial performance.

By focusing on sustainable stocks, investors can align their portfolios with ethical and environmental values while tapping into a growing market. The rail sector's transition toward sustainability is still in its early stages, offering ample opportunities for early adopters to reap significant rewards. As Boston's commuter rail network continues to evolve, sustainable stocks are likely to play an increasingly important role in shaping its future.

What Role Do Technological Innovations Play in Stock Performance?

Technological innovations are revolutionizing the commuter rail sector, and their impact on stock performance cannot be overstated. From advanced signaling systems to AI-driven predictive maintenance, these innovations enhance operational efficiency, reduce costs, and improve passenger experiences. Companies at the forefront of these advancements often see their stocks outperform the market, as investors recognize the long-term benefits of technological leadership.

For example, the integration of Internet of Things (IoT) devices in rail infrastructure allows for real-time monitoring and data analysis, leading to more efficient operations. Companies like Hitachi Rail and Thales Group are leveraging IoT to create smarter rail networks, positioning themselves as industry leaders. Similarly, advancements in autonomous train technology are opening new avenues for growth, with companies like Alstom investing heavily in this space. These technological leaps not only improve service reliability but also attract investor interest due to their potential to disrupt traditional business models.

Investors should also consider how technological adoption influences competitive dynamics. Companies slow to embrace innovation risk falling behind, while those leading the charge can capture significant market share. By focusing on firms with robust R&D pipelines and a commitment to technological excellence, investors can identify stocks with strong growth potential. As Boston's commuter rail sector continues to modernize, technological innovations will remain a key driver of stock performance.

Emerging Technologies Transforming the Commuter Rail Industry

The commuter rail industry is undergoing a technological renaissance, with several emerging trends reshaping its landscape. One of the most significant developments is the adoption of artificial intelligence (AI) and machine learning to optimize operations. These technologies enable predictive maintenance, reducing downtime and improving service reliability. For instance, AI algorithms can analyze data from sensors installed on trains to predict potential failures before they occur, saving both time and money.

Another transformative technology is the use of renewable energy sources to power rail networks. Solar panels and wind turbines are increasingly being integrated into rail infrastructure to reduce reliance on fossil fuels. This shift not only lowers operational costs but also aligns with global sustainability goals. Companies investing in renewable energy solutions are likely to see their stocks perform well as environmental regulations tighten and consumer preferences shift toward eco-friendly options.

Finally, digital ticketing and mobile apps are enhancing the passenger experience while generating valuable data for rail operators. These platforms allow for seamless ticket purchases, real-time updates, and personalized services, increasing customer satisfaction and loyalty. As these technologies become more widespread, they will play a crucial role in shaping the future of Boston's commuter rail sector and influencing stock performance.

Is Sustainability a Game-Changer for Commuter Rail Stocks?

Sustainability is rapidly becoming a game-changer for commuter rail stocks, as environmental considerations take center stage in investment decisions. Rail transport is already one of the most sustainable modes of transportation, emitting significantly fewer greenhouse gases compared to cars and airplanes. However, companies are going a step further by adopting green technologies and practices to enhance their sustainability credentials. This shift is not only attracting environmentally conscious investors but also positioning these companies as leaders in the transition to a low-carbon economy.

One of the key ways sustainability is influencing stock performance is through regulatory incentives. Governments worldwide are offering tax breaks, subsidies, and grants to companies investing in eco-friendly solutions. For example, firms developing electric or hydrogen-powered trains are receiving financial support to accelerate their research and development efforts. These incentives not only reduce operational costs but also enhance profitability, making their stocks more attractive to investors.

Moreover, sustainability initiatives are improving brand reputation and customer loyalty. Passengers are increasingly choosing rail operators that prioritize environmental responsibility, leading to higher ridership and revenue. Companies that fail to adapt risk losing market share and facing public backlash, which can negatively impact their stock prices. By embracing sustainability, commuter rail companies can secure a competitive edge and drive long-term growth, making them key players in the investment landscape.

How Can Investors Evaluate Growth Potential in This Sector?

Evaluating growth potential in Boston's commuter rail sector requires a multifaceted approach, combining financial analysis, industry trends, and macroeconomic factors. One of the first steps is to examine the financial health of key companies. Metrics such as revenue growth, profit margins, and debt-to-equity ratios provide valuable insights into a company's stability and ability to capitalize on market opportunities. Investors should also analyze earnings reports and future guidance to gauge how well these companies are positioned for long-term success.

Industry trends are another critical factor to consider. For instance, the increasing demand for sustainable transit solutions and the rise of smart rail technologies are reshaping the sector's growth trajectory. Companies that are early adopters of these trends often outperform their peers, making their stocks more attractive. Additionally, understanding the competitive landscape is essential. Investors should assess how companies differentiate themselves through innovation, partnerships, and market share to identify those with the strongest growth potential.

Finally, macroeconomic factors such as government policies, infrastructure spending, and urbanization trends play a significant role in shaping the sector's future. For example, increased funding for public transit projects can create lucrative opportunities for companies involved in construction, maintenance, and technology integration. By considering these factors holistically, investors