What is Monzo banking, and why has it become a game-changer in the financial world? Monzo is a digital bank that has taken the UK by storm, offering a modern, app-based banking experience that prioritizes convenience, transparency, and innovation. Founded in 2015, Monzo has grown from a small fintech startup to a household name, serving millions of customers who appreciate its seamless integration of technology and finance. With its iconic coral-colored debit card and intuitive mobile app, Monzo has redefined how people manage their money in the digital age.

Monzo stands out as a challenger bank, challenging traditional banking norms by providing a fully digital experience without the need for physical branches. Its focus on real-time notifications, budgeting tools, and fee-free international spending has made it a favorite among millennials and Gen Z users. Whether you're looking to track your daily expenses, save for a rainy day, or manage your salary in a smarter way, Monzo offers a suite of features designed to make personal finance effortless and enjoyable.

But what exactly sets Monzo apart from other banks? Unlike traditional institutions, Monzo operates entirely online, allowing users to open accounts, manage transactions, and access customer support—all from their smartphones. Its commitment to transparency means no hidden fees, while its community-driven approach ensures that customer feedback shapes the bank's evolution. In this guide, we'll explore everything you need to know about Monzo banking, from its origins to its standout features and how it compares to other financial institutions. Let’s dive in!

Read also:Ultimate Guide To The Transformative Power Of Opus Clip In Content Creation

- What is Monzo Banking and How Did It Start?

- How Does Monzo Banking Work?

- What Are the Key Features of Monzo Banking?

- Why Choose Monzo Banking Over Traditional Banks?

- Is Monzo Banking Safe and Secure?

- How Does Monzo Banking Support Budgeting and Savings?

- What Are the Pros and Cons of Monzo Banking?

- Frequently Asked Questions About Monzo Banking

What is Monzo Banking and How Did It Start?

Monzo's journey began in 2015 when a group of entrepreneurs, including Tom Blomfield, envisioned a new kind of bank—one that would eliminate the frustrations associated with traditional banking. The founders wanted to create a bank that was accessible, transparent, and user-centric. Their goal was to leverage technology to offer a banking experience that felt modern and intuitive, catering to a generation that values convenience and digital-first solutions.

Initially launched as a prepaid card, Monzo quickly evolved into a fully-fledged digital bank after receiving its banking license in 2017. The bank's early days were marked by rapid growth, driven by word-of-mouth and a loyal user base that appreciated its innovative features. Monzo's beta testing phase saw thousands of users signing up, eager to try out its real-time notifications and budgeting tools. By 2018, Monzo had reached one million customers, a testament to its appeal and the trust it had built among users.

How Did Monzo Gain Popularity So Quickly?

One of the key factors behind Monzo's rapid rise was its focus on solving real-world problems. For example, the bank introduced features like instant transaction notifications, which alerted users every time their card was used. This level of transparency was unheard of in traditional banking and gave users peace of mind. Additionally, Monzo's app was designed to be intuitive, making it easy for even non-tech-savvy individuals to navigate.

What Role Did Community Feedback Play?

Monzo's success can also be attributed to its community-driven approach. The bank actively sought feedback from its users, often implementing suggestions into its platform. This collaborative relationship with its customers fostered a sense of ownership and loyalty, turning Monzo users into brand advocates. By prioritizing customer needs, Monzo was able to stay ahead of the curve and continuously improve its offerings.

How Does Monzo Banking Work?

Monzo operates as a fully digital bank, meaning there are no physical branches to visit. Instead, everything is managed through its mobile app, which serves as the central hub for all banking activities. To get started, users simply download the app, verify their identity, and order a Monzo card. Once the card arrives, it can be activated through the app, and users can begin making transactions immediately.

What Are the Steps to Open a Monzo Account?

- Download the Monzo app from the App Store or Google Play.

- Create an account by entering your personal details and verifying your identity through a secure process.

- Order your Monzo card, which is delivered to your address within a few days.

- Activate the card through the app and set up your PIN.

- Start using your Monzo account for everyday transactions.

How Does Monzo Handle Transactions?

Monzo processes transactions in real-time, providing users with instant notifications whenever their card is used. This feature not only enhances security but also helps users stay on top of their spending. Additionally, Monzo offers fee-free spending abroad, making it an attractive option for frequent travelers.

Read also:Eden Eloise Holyfield The Rising Star Ndash Biography Achievements And Legacy

What Are the Key Features of Monzo Banking?

Monzo is packed with features designed to simplify personal finance. One of its standout offerings is the ability to categorize spending automatically. For instance, the app can identify whether a transaction was for groceries, entertainment, or transportation, helping users understand where their money is going. Another popular feature is "Pots," which allows users to set aside money for specific goals, such as vacations or emergency funds.

How Does Monzo Support Budgeting?

Budgeting is made easy with Monzo's built-in tools. Users can set monthly spending limits for different categories and receive alerts when they're approaching their limits. This proactive approach helps users avoid overspending and stay on track with their financial goals.

What About Savings and Investments?

Monzo also offers savings accounts with competitive interest rates, as well as partnerships with investment platforms. This allows users to grow their money while keeping everything in one place.

Why Choose Monzo Banking Over Traditional Banks?

Choosing Monzo over a traditional bank comes down to convenience, transparency, and innovation. Unlike traditional banks, which often have complex fee structures and limited digital capabilities, Monzo offers a streamlined experience that prioritizes the user. Its app is intuitive, and its features are designed to make banking effortless.

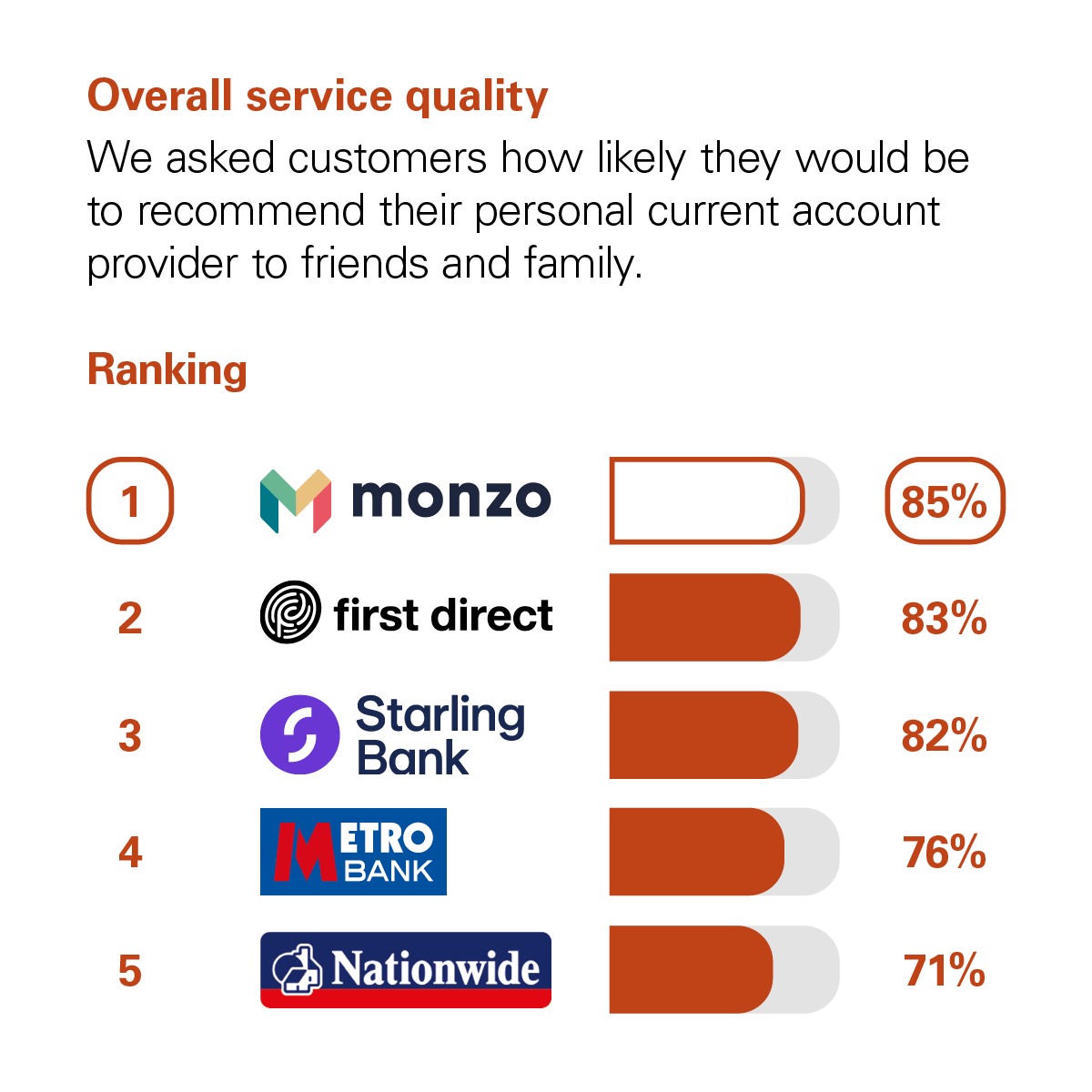

How Does Monzo Compare to Other Challenger Banks?

While there are other challenger banks like Revolut and Starling, Monzo stands out for its community focus and customer-centric approach. Its real-time notifications and budgeting tools are among the best in the industry, making it a top choice for those seeking a modern banking solution.

Is Monzo Banking Safe and Secure?

Security is a top priority for Monzo. The bank uses advanced encryption and fraud detection systems to protect user data. Additionally, Monzo is regulated by the Financial Conduct Authority (FCA) and the Prudential Regulation Authority (PRA), ensuring that it adheres to strict security standards.

How Does Monzo Banking Support Budgeting and Savings?

Monzo's budgeting tools are designed to help users take control of their finances. From setting spending limits to tracking expenses, the app provides a comprehensive overview of financial health. Its savings features, including "Pots" and interest-bearing accounts, further enhance its appeal.

What Are the Pros and Cons of Monzo Banking?

Pros

- Real-time transaction notifications

- Fee-free international spending

- Intuitive budgeting tools

Cons - No physical branches

- Limited investment options compared to traditional banks

Frequently Asked Questions About Monzo Banking

Is Monzo Banking Free to Use?

Yes, Monzo offers a free standard account with no hidden fees. However, premium features like Monzo Plus come with a subscription fee.

Can I Use Monzo Outside the UK?

Monzo cards can be used abroad with no foreign transaction fees, making it a great option for travelers.

How Do I Contact Monzo Customer Support?

Monzo offers 24/7 customer support through its app, where users can chat with representatives or access a help center.

In conclusion, what is Monzo banking if not a revolutionary step forward in personal finance? With its innovative features, commitment to transparency, and user-friendly design, Monzo has earned its place as a leader in the digital banking space. Whether you're a seasoned budgeter or just starting to take control of your finances, Monzo offers the tools and support you need to succeed. Learn more about Monzo here.