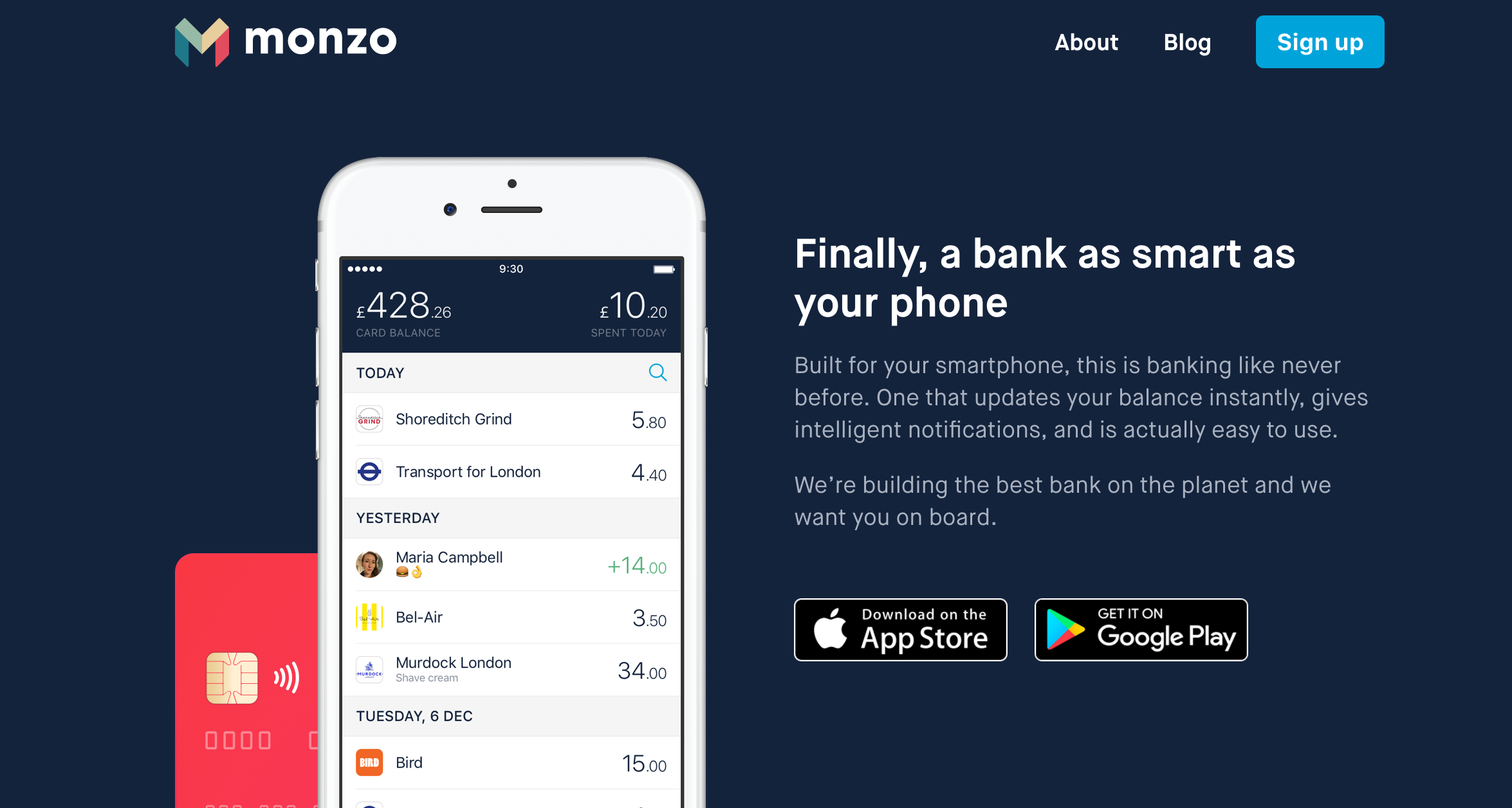

Monzo Bank has revolutionized the banking industry in the UK with its innovative digital-first approach, offering customers a seamless, user-friendly banking experience. Established in 2015, Monzo has grown rapidly to become one of the most popular challenger banks in the country. Its vibrant coral-colored debit card and intuitive mobile app have captured the attention of millions, making it a symbol of modern banking convenience. With over 8 million customers as of 2023, Monzo has positioned itself as a leader in the fintech space, offering services that cater to both personal and business banking needs.

What sets Monzo Bank apart is its commitment to transparency and customer-centric innovation. Unlike traditional banks, Monzo provides real-time notifications for every transaction, helping users stay on top of their spending. It also offers budgeting tools, savings pots, and instant spending insights that empower customers to manage their finances effectively. Monzo’s fee-free international spending and ATM withdrawals (within limits) have made it especially appealing to travelers and expats. The bank’s mission to "make money work for everyone" is reflected in its user-friendly features and accessible financial products.

Monzo’s rise has not been without challenges, but its ability to adapt and innovate has kept it ahead of the curve. From its humble beginnings as a startup to its current status as a publicly listed company on the London Stock Exchange, Monzo has demonstrated resilience and vision. Whether you’re considering switching to Monzo or simply curious about its offerings, this guide will delve into everything you need to know about Monzo Bank, its features, and its impact on the future of banking.

Read also:Julie Pitt Actress Model Latest News Photos

Table of Contents

- What is Monzo Bank and How Does It Work?

- Why Should You Choose Monzo Over Traditional Banks?

- Monzo Bank Features That Are Changing the Game

- How Does Monzo Bank Ensure Security and Privacy?

- What Are the Pros and Cons of Using Monzo?

- How to Get Started with Monzo Bank?

- Monzo Bank vs. Other Digital Banks: A Comparison

- Frequently Asked Questions About Monzo Bank

What is Monzo Bank and How Does It Work?

Monzo Bank is a UK-based digital bank that operates entirely through its mobile app, eliminating the need for physical branches. Founded in 2015 by Tom Blomfield, Jonas Huckestein, and a team of fintech enthusiasts, Monzo was designed to address the pain points of traditional banking. It offers a wide range of financial services, including current accounts, savings accounts, business accounts, and investment options. Monzo’s app is the centerpiece of its operations, providing users with a dashboard to manage their finances, track spending, and access customer support.

How does Monzo work? When you sign up for Monzo, you’ll receive a coral-colored debit card linked to your account. This card can be used for contactless payments, online shopping, and ATM withdrawals. Every transaction is instantly reflected in the app, complete with notifications and categorization. For instance, if you buy a coffee, Monzo will categorize it under "Food & Drink" and update your spending insights accordingly. This real-time functionality is one of Monzo’s standout features, as it helps users stay informed and in control of their finances.

Monzo’s business model is built on subscription services and interchange fees. While its basic account is free, Monzo offers premium accounts like Monzo Plus and Monzo Pro, which come with additional perks such as travel insurance, lounge access, and exclusive discounts. The bank also earns revenue through partnerships with third-party services, such as bill-splitting apps and investment platforms. By combining cutting-edge technology with customer-focused solutions, Monzo has created a banking experience that feels modern and intuitive.

How Does Monzo Compare to Traditional Banks?

Unlike traditional banks, Monzo operates without physical branches, relying entirely on its app for customer interactions. This digital-first approach allows Monzo to offer faster services, lower fees, and a more personalized experience. For example, opening a Monzo account takes just a few minutes, compared to the days or weeks it might take with a traditional bank. Additionally, Monzo’s budgeting tools and instant notifications are features that many traditional banks lack.

Is Monzo Safe to Use?

Security is a top priority for Monzo. The bank employs advanced encryption and fraud detection systems to protect user data. Monzo also offers features like instant card freezing and two-factor authentication to ensure account safety. In case of unauthorized transactions, Monzo provides a robust dispute resolution process to help users recover their funds.

Why Should You Choose Monzo Over Traditional Banks?

Choosing Monzo over traditional banks can be a game-changer for many users. One of the most compelling reasons is its simplicity. With Monzo, you don’t need to visit a branch or wait in long queues to resolve issues. Everything from opening an account to managing your finances can be done through the app. This convenience is particularly appealing to younger generations who prefer digital solutions over in-person interactions.

Read also:Cobra Kai Season 7 What To Expect And Why Fans Are Excited

Another advantage of Monzo is its transparency. Traditional banks often charge hidden fees for services like international transactions or overdrafts, but Monzo clearly outlines its charges upfront. For example, Monzo offers fee-free spending abroad up to a certain limit, making it a cost-effective choice for frequent travelers. Additionally, Monzo’s budgeting tools and savings pots help users save money effortlessly, which is something many traditional banks fail to offer.

What Are the Key Benefits of Monzo?

- Real-Time Notifications: Get instant updates on every transaction, helping you track your spending.

- Free International Spending: Use your Monzo card abroad without worrying about fees (within limits).

- Easy Account Setup: Open an account in minutes using just your smartphone.

- Integrated Budgeting Tools: Categorize expenses and set spending limits to manage your finances better.

How Does Monzo Support Financial Wellness?

Monzo’s focus on financial wellness is evident in its features. The app allows users to create savings pots for specific goals, such as vacations or emergency funds. It also offers round-up savings, where spare change from purchases is automatically saved. These tools encourage users to build healthy financial habits without much effort.

Monzo Bank Features That Are Changing the Game

Monzo Bank is packed with innovative features that set it apart from its competitors. One of its most popular features is the ability to categorize spending automatically. Every time you make a purchase, Monzo assigns it to a category like "Groceries," "Entertainment," or "Transport." This categorization helps users understand where their money is going and adjust their spending habits accordingly.

Another standout feature is Monzo’s savings pots. These virtual jars allow users to set aside money for specific goals, such as a holiday or a new gadget. You can even set up automatic transfers to these pots, making saving effortless. For instance, if you want to save £100 for a weekend getaway, you can create a pot and contribute small amounts regularly until you reach your target.

What Makes Monzo’s Features Unique?

Monzo’s unique selling point is its focus on user experience. The app is designed to be intuitive, with features like bill splitting, joint accounts, and energy switching services. These tools are not just functional but also enhance the overall banking experience. For example, Monzo’s energy switching service helps users find cheaper utility providers, saving them money without any hassle.

How Does Monzo Bank Ensure Security and Privacy?

Security is a top priority for Monzo Bank. The platform uses state-of-the-art encryption to protect user data and employs machine learning algorithms to detect fraudulent activity. Monzo also offers features like instant card freezing and two-factor authentication to ensure account safety.

What Should You Do If Your Monzo Account Is Compromised?

If you suspect unauthorized activity on your Monzo account, you can freeze your card instantly through the app. Monzo’s customer support team is available 24/7 to assist with disputes and refunds, ensuring a hassle-free resolution process.

What Are the Pros and Cons of Using Monzo?

Pros

- User-friendly app with real-time notifications

- Free international spending and ATM withdrawals (within limits)

- Integrated budgeting tools and savings pots

- No hidden fees or charges

Cons

- Limited physical presence (no branches)

- Premium accounts come with subscription fees

- Not ideal for users who prefer in-person banking

How to Get Started with Monzo Bank?

Getting started with Monzo is simple. Download the app, enter your details, and verify your identity using your phone’s camera. Once approved, you’ll receive your Monzo card in the mail, and you can start using it immediately.

Monzo Bank vs. Other Digital Banks: A Comparison

Monzo competes with other digital banks like Revolut and Starling. While all three offer similar features, Monzo stands out for its budgeting tools and user-friendly interface. Revolut, on the other hand, focuses more on global banking, while Starling emphasizes business accounts.

Frequently Asked Questions About Monzo Bank

Is Monzo Bank Regulated?

Yes, Monzo is regulated by the Financial Conduct Authority (FCA) and the Prudential Regulation Authority (PRA).

Can I Use Monzo for Business?

Yes, Monzo offers business accounts with features like invoicing and expense tracking.

What Happens If I Lose My Monzo Card?

You can freeze your card instantly through the app and order a replacement.

Conclusion

Monzo Bank has redefined the way people manage their finances, offering a seamless blend of convenience, transparency, and innovation. Whether you’re looking for a simple way to track your spending or a comprehensive financial management tool, Monzo has something for everyone. Its commitment to user experience and security makes it a standout choice in the world of digital banking.

For more information, visit Monzo’s official website.

/Monzo_(bank)-Logo.wine.png)