Unlike traditional banks that rely heavily on brick-and-mortar locations, Monzo operates exclusively as a digital bank. This means it doesn’t have physical branches where customers can walk in to open accounts or resolve issues. Instead, Monzo focuses on providing an intuitive mobile app and 24/7 customer support through chat and phone. This approach has attracted millions of users who value convenience and digital accessibility over in-person banking services. As the world shifts toward digital-first solutions, Monzo's model raises important questions about the future of banking. Does the absence of physical branches limit its appeal, or does it enhance user experience by cutting out unnecessary overhead? Monzo’s success suggests that many customers are ready to embrace a fully digital banking experience. However, for those who prefer face-to-face interactions, this model may not be the perfect fit. By exploring Monzo’s operations, customer service, and alternatives for in-person banking, we can gain a clearer understanding of whether a physical presence is truly necessary for a modern bank. In this article, we’ll dive deep into Monzo’s digital-only approach, examine its advantages and disadvantages, and explore how it compares to traditional banks with physical branches. We’ll also address common concerns, such as how Monzo handles customer issues without physical locations and whether this model is sustainable in the long term. By the end, you’ll have a comprehensive understanding of Monzo’s banking philosophy and whether it aligns with your financial needs.

- Does Monzo Have a Physical Bank? What You Need to Know

- How Does Monzo Operate Without Physical Branches?

- Is a Digital-Only Bank Right for You?

- What Are the Advantages of Using Monzo?

- How Does Monzo Handle Customer Support Without Branches?

- How Does Monzo Compare to Traditional Banks with Physical Locations?

- What Are the Alternatives if You Prefer In-Person Banking?

- FAQs About Monzo and Physical Banking

Does Monzo Have a Physical Bank? What You Need to Know

If you’re wondering whether Monzo has a physical bank, the short answer is no. Monzo operates exclusively as a digital bank, meaning it doesn’t have any physical branches where customers can walk in for services. Instead, Monzo provides all its banking services through its mobile app and online platform. This decision aligns with Monzo’s mission to create a modern, accessible banking experience that caters to tech-savvy users. By eliminating the need for physical locations, Monzo reduces operational costs, which allows it to offer features like fee-free international spending and instant notifications for transactions.

Why Did Monzo Choose a Digital-Only Model?

Monzo’s decision to remain digital-only is rooted in its vision of simplifying banking. Traditional banks often rely on physical branches to provide services, but this model can be costly and time-consuming for customers. Monzo recognized that many banking tasks, such as checking balances, transferring money, and paying bills, could be handled more efficiently through a mobile app. By focusing on digital solutions, Monzo has been able to streamline processes and offer a user-friendly interface that appeals to a wide audience.

Read also:Sandahl Bergman The Iconic Actress Who Redefined Action Cinema

How Does Monzo Ensure Accessibility Without Branches?

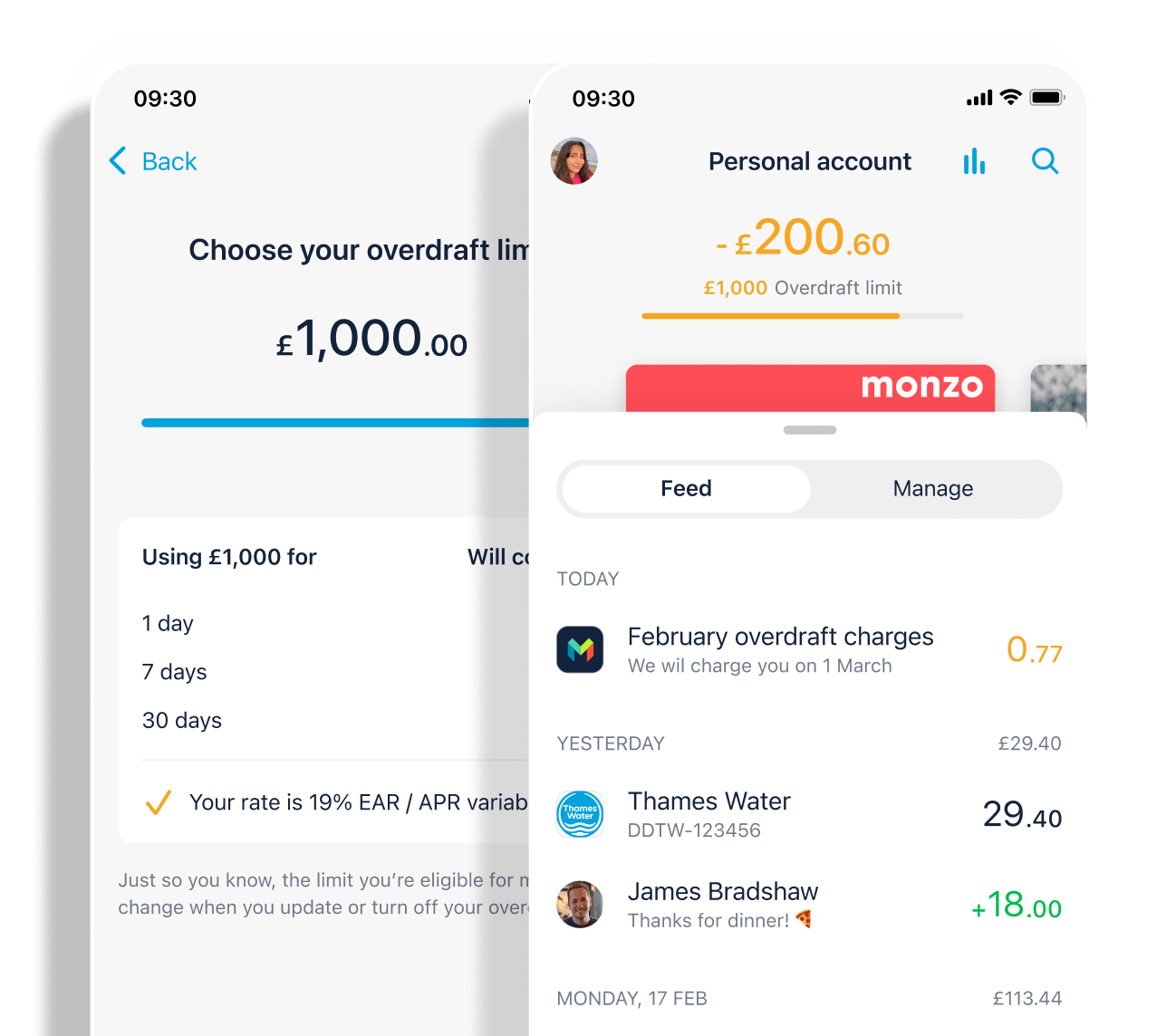

Despite not having physical branches, Monzo has implemented several measures to ensure accessibility for its customers. For example, the app is designed to be intuitive, with features like budgeting tools, spending categorization, and real-time notifications. Additionally, Monzo provides 24/7 customer support through in-app chat and phone calls, ensuring that users can resolve issues quickly and conveniently. These features help bridge the gap left by the absence of physical locations, making Monzo a viable option for those who prioritize digital convenience.

How Does Monzo Operate Without Physical Branches?

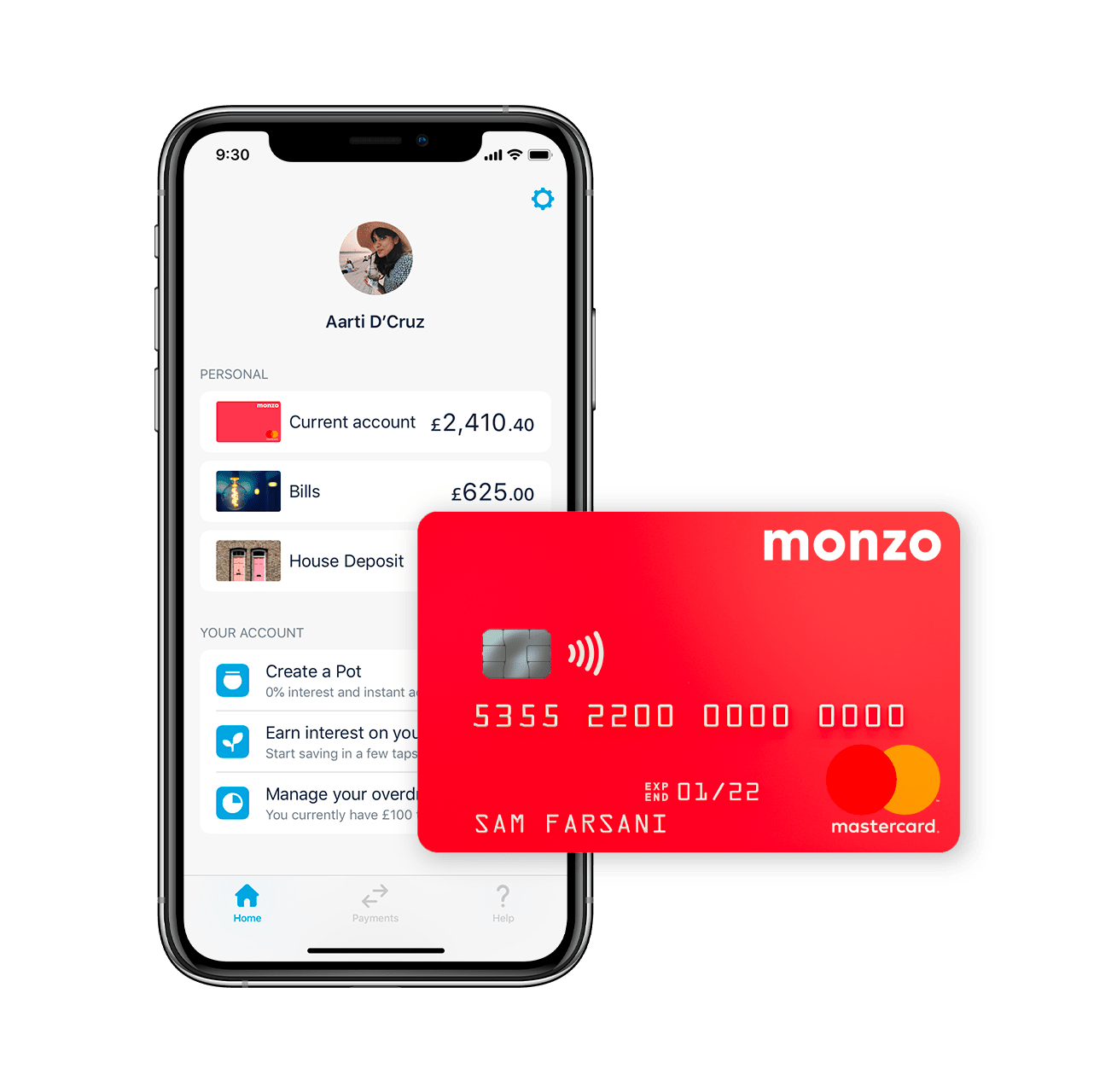

Operating without physical branches requires a robust infrastructure and a focus on digital innovation. Monzo achieves this by leveraging cutting-edge technology and a customer-centric approach. All banking services, from opening an account to managing finances, are conducted through the Monzo app. This eliminates the need for customers to visit a branch, saving time and reducing the hassle associated with traditional banking.

What Are the Key Features of Monzo’s Digital Platform?

Monzo’s digital platform is packed with features that make banking seamless and efficient. Some of the standout features include:

- Instant Notifications: Receive real-time alerts for every transaction, helping you stay on top of your spending.

- Budgeting Tools: Categorize your spending and set budgets to manage your finances effectively.

- International Spending: Use your Monzo card abroad without worrying about excessive fees.

- Joint Accounts: Share a Monzo account with a partner or family member for easier financial management.

How Does Monzo Ensure Security Without Physical Oversight?

Security is a top priority for Monzo, even without physical branches. The bank employs advanced encryption and fraud detection systems to protect customer data. Additionally, users can freeze their cards instantly through the app if they suspect unauthorized activity. These measures ensure that Monzo’s digital-only model is not only convenient but also secure.

Is a Digital-Only Bank Right for You?

Deciding whether a digital-only bank like Monzo is right for you depends on your banking preferences and lifestyle. For individuals who value convenience, real-time updates, and a modern banking experience, Monzo is an excellent choice. However, if you prefer face-to-face interactions or need in-person assistance for complex financial matters, a traditional bank with physical branches might be a better fit.

What Are the Benefits of Choosing a Digital-Only Bank?

Digital-only banks like Monzo offer several advantages, including:

Read also:Is Brad Mondo Dating Sophia Everything You Need To Know About Their Relationship

- Convenience: Access your account anytime, anywhere, using just your smartphone.

- Lower Fees: Reduced operational costs often translate to lower fees for customers.

- Innovative Features: Enjoy cutting-edge tools that enhance your banking experience.

What Are the Potential Drawbacks?

While digital-only banks have many benefits, they also come with some drawbacks:

- Limited In-Person Support: Without physical branches, resolving complex issues may require more time.

- Technology Dependence: A reliable internet connection is essential for accessing services.

What Are the Advantages of Using Monzo?

Monzo’s digital-only model offers numerous advantages that have contributed to its popularity. From its user-friendly app to its innovative features, Monzo has redefined what it means to bank in the digital age. Here are some of the key benefits:

- Seamless User Experience: The app is intuitive and easy to navigate, even for first-time users.

- Financial Insights: Gain a clear understanding of your spending habits with detailed analytics.

- Global Accessibility: Use your Monzo card abroad without worrying about hidden fees.

How Does Monzo Compare to Other Digital Banks?

Compared to other digital banks, Monzo stands out for its comprehensive feature set and customer support. While many digital banks offer similar services, Monzo’s focus on user experience and accessibility gives it an edge. For example, its real-time notifications and budgeting tools are unmatched by many competitors.

How Does Monzo Handle Customer Support Without Branches?

Customer support is a critical aspect of any banking service, and Monzo excels in this area despite not having physical branches. The bank offers 24/7 support through its app, allowing users to chat with representatives or call for assistance at any time. This ensures that customers can resolve issues quickly and efficiently, even without in-person interactions.

What Are the Available Support Channels?

Monzo provides multiple support channels to cater to different customer needs:

- In-App Chat: Get instant help by chatting with a representative directly through the app.

- Phone Support: Call Monzo’s customer service team for more complex issues.

- Community Forum: Engage with other Monzo users to share tips and solutions.

How Does Monzo Ensure Customer Satisfaction?

Monzo prioritizes customer satisfaction by offering responsive and reliable support. The bank’s representatives are trained to handle a wide range of issues, from account setup to fraud prevention. Additionally, Monzo’s community forum fosters a sense of belonging among users, creating a supportive environment for problem-solving.

How Does Monzo Compare to Traditional Banks with Physical Locations?

When comparing Monzo to traditional banks, several key differences stand out. While traditional banks offer the advantage of physical branches, Monzo excels in digital innovation and convenience. Here’s a breakdown of how the two models compare:

- Accessibility: Monzo is accessible 24/7 through its app, while traditional banks have limited branch hours.

- Cost: Monzo often has lower fees due to reduced overhead costs.

- Features: Monzo’s app offers advanced tools that many traditional banks lack.

What Are the Trade-Offs?

While Monzo offers many advantages, traditional banks still have their merits. For example, some customers may prefer the personal touch of face-to-face interactions or the ability to deposit cash at a physical location. These factors should be considered when choosing between Monzo and a traditional bank.

What Are the Alternatives if You Prefer In-Person Banking?

If you prefer in-person banking, there are several alternatives to Monzo. Traditional banks like Barclays, HSBC, and Lloyds offer physical branches where you can conduct transactions and seek assistance. Additionally, some digital banks partner with physical networks to provide cash deposit services.

Which Banks Offer the Best In-Person Services?

When looking for a bank with strong in-person services, consider the following:

- Barclays: Known for its extensive branch network and customer service.

- HSBC: Offers global reach and a wide range of services.

- Lloyds: Provides a balanced mix of digital and physical banking options.

How Can You Combine Digital and Physical Banking?

For those who want the best of both worlds, consider using a digital bank for everyday transactions and a traditional bank for cash deposits and in-person support. This hybrid approach allows you to enjoy the convenience of digital banking while still having access to physical branches when needed.

FAQs About Monzo and Physical Banking

Does Monzo Have a Physical Bank?

No, Monzo operates exclusively as a digital bank without any physical branches. All services are accessible through its mobile app and online platform.

Can I Deposit Cash with Monzo?

Monzo doesn’t offer direct cash deposit services, but you can use partner networks like the Post Office or PayPoint to add cash to your account.

How Does Monzo Handle Complex Financial Issues?

Monzo provides 24/7 customer support through its app and phone lines. For complex issues, representatives are trained to offer detailed assistance and guidance.

Conclusion

Monzo’s digital-only banking model represents the future of finance, offering convenience, innovation, and accessibility to millions of users worldwide. While it doesn’t have physical branches, Monzo’s robust app and customer support ensure that users can manage their finances effectively. By understanding Monzo’s strengths and limitations, you can determine whether it’s the right choice for your