With its global presence and reputation for quality service, Cigna has become synonymous with reliable health coverage. Whether you're seeking individual plans, family coverage, or employer-sponsored benefits, Cigna provides tailored solutions that prioritize accessibility, affordability, and comprehensive care. Their innovative approach to healthcare ensures that policyholders receive not only financial protection but also access to a vast network of healthcare providers and wellness resources. From preventive care to specialized treatments, Cigna’s commitment to enhancing the health and well-being of its members is evident in every aspect of its offerings. In today’s fast-paced world, navigating the complexities of health insurance can feel overwhelming. Cigna simplifies this process by offering user-friendly tools and resources to help you make informed decisions about your healthcare. Their plans are designed to cater to a variety of lifestyles and budgets, ensuring that everyone can find a policy that aligns with their unique needs. With features like telemedicine services, wellness programs, and 24/7 customer support, Cigna empowers its members to take charge of their health. Additionally, their emphasis on transparency ensures that policyholders understand their coverage, costs, and benefits, fostering trust and confidence in their healthcare choices. As healthcare costs continue to rise, having a reliable insurance provider like Cigna becomes increasingly important. Their plans not only offer financial protection but also promote proactive health management through preventive care and wellness incentives. By partnering with a wide network of healthcare professionals and facilities, Cigna ensures that its members have access to high-quality care whenever and wherever they need it. Whether you’re evaluating your current coverage or exploring new options, understanding what Cigna Health Insurance offers can help you make the best decision for your health and financial well-being.

Table of Contents

- What is Cigna Health Insurance?

- How Does Cigna Health Insurance Work?

- Types of Cigna Health Insurance Plans

- What Are the Benefits of Choosing Cigna?

- How to Choose the Right Cigna Health Insurance Plan?

- Is Cigna Health Insurance Cost-Effective?

- How Does Cigna Support Mental Health?

- Frequently Asked Questions About Cigna Health Insurance

What is Cigna Health Insurance?

Cigna Health Insurance is a globally recognized provider of health coverage solutions, catering to individuals, families, and businesses alike. Founded in 1982, Cigna has grown to become a leader in the insurance industry, offering innovative plans that emphasize affordability, accessibility, and comprehensive care. With its headquarters in Bloomfield, Connecticut, Cigna operates in over 30 countries, serving millions of customers worldwide. Its mission is to improve the health, well-being, and peace of mind of those it serves by delivering personalized healthcare solutions.

At its core, Cigna Health Insurance is designed to provide financial protection against unexpected medical expenses while promoting proactive health management. Their plans typically cover a wide range of services, including preventive care, hospital stays, prescription medications, and specialist visits. By partnering with a vast network of healthcare providers, Cigna ensures that its members have access to high-quality care at reduced costs. Additionally, Cigna’s emphasis on digital tools and resources, such as mobile apps and online portals, makes it easier for policyholders to manage their health and insurance needs efficiently.

Read also:Truett Hanes Height Unveiling The Facts Behind The Famous Figure

What sets Cigna apart from other insurance providers is its commitment to innovation and customer-centric solutions. For example, their wellness programs and telemedicine services empower members to take charge of their health from the comfort of their homes. Furthermore, Cigna’s focus on transparency ensures that policyholders fully understand their coverage options, costs, and benefits. This approach not only builds trust but also enhances the overall customer experience, making Cigna a preferred choice for many seeking reliable health insurance.

How Does Cigna Health Insurance Work?

Cigna Health Insurance operates on a straightforward yet flexible model that prioritizes accessibility and convenience for its members. When you enroll in a Cigna plan, you gain access to a network of healthcare providers, including doctors, hospitals, and specialists, who have agreed to offer services at negotiated rates. This network-based system helps reduce out-of-pocket costs for policyholders while ensuring they receive high-quality care. Depending on the type of plan you choose, you may have the option to visit in-network providers exclusively or seek care outside the network, albeit at a higher cost.

One of the key features of Cigna’s system is its emphasis on preventive care. Many of their plans cover routine check-ups, vaccinations, and screenings at no additional cost to the policyholder. This focus on prevention not only helps members stay healthy but also reduces the likelihood of costly medical treatments down the line. Additionally, Cigna offers tools like cost estimators and health savings accounts (HSAs) to help members manage their healthcare expenses effectively. These resources empower individuals to make informed decisions about their care while staying within their budget.

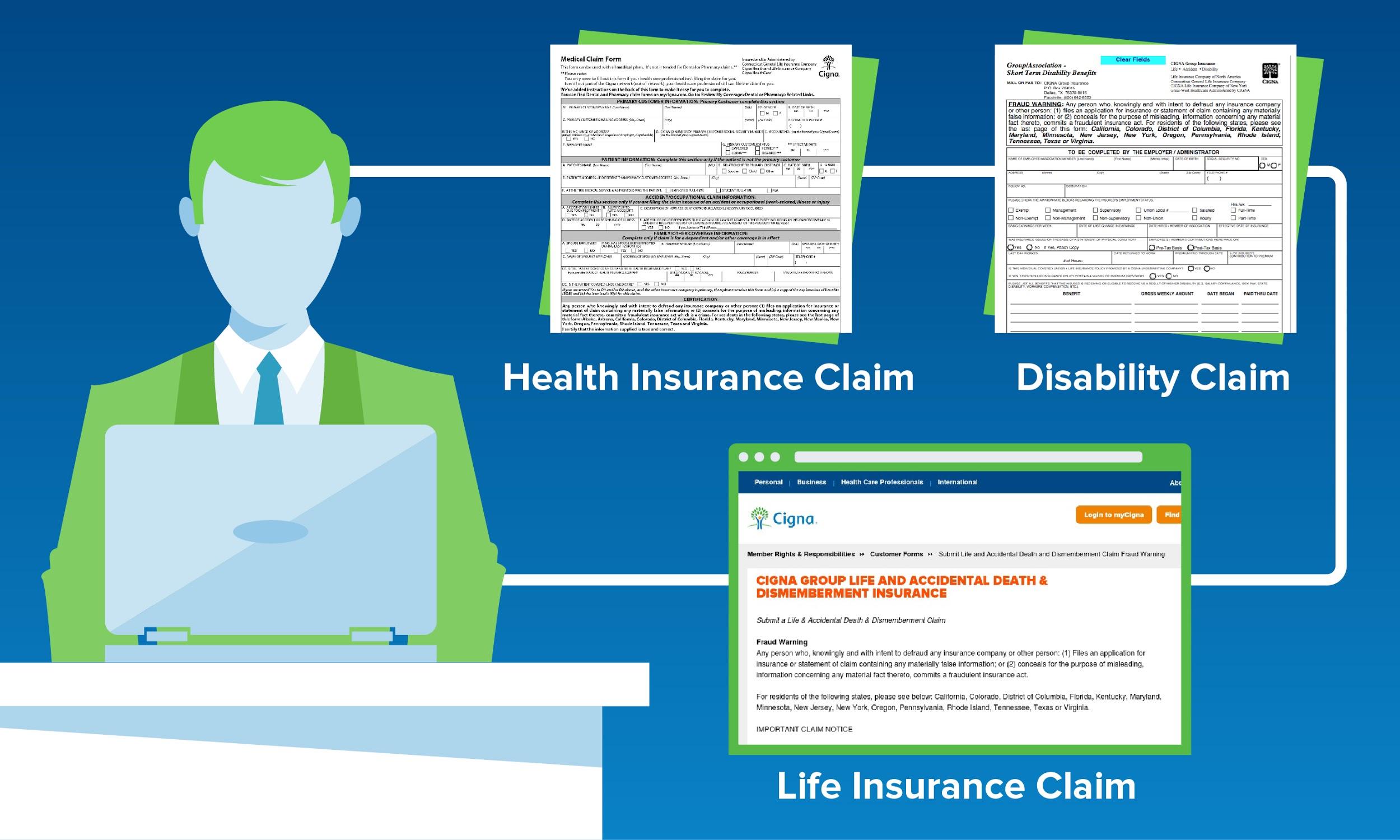

Claims processing is another critical aspect of how Cigna Health Insurance works. When you receive medical services, your healthcare provider typically submits a claim to Cigna on your behalf. Cigna then reviews the claim, determines the covered amount, and pays the provider directly. Any remaining balance, such as copayments or deductibles, is billed to the policyholder. This streamlined process ensures that members can focus on their recovery without worrying about complex paperwork or delays in reimbursement.

Types of Cigna Health Insurance Plans

Cigna offers a diverse range of health insurance plans, each tailored to meet the unique needs of individuals, families, and businesses. Understanding these options is crucial for selecting the right coverage that aligns with your lifestyle and budget. Below, we explore the most common types of Cigna Health Insurance plans available:

- Health Maintenance Organization (HMO) Plans: These plans require members to choose a primary care physician (PCP) and obtain referrals to see specialists. HMOs are known for their lower premiums and out-of-pocket costs but limit coverage to in-network providers.

- Preferred Provider Organization (PPO) Plans: PPOs offer more flexibility by allowing members to visit both in-network and out-of-network providers without a referral. While premiums are typically higher than HMOs, PPOs provide greater freedom in choosing healthcare professionals.

- Exclusive Provider Organization (EPO) Plans: EPOs combine features of HMOs and PPOs, offering coverage only within the network but without the need for referrals to see specialists. This plan is ideal for those who prioritize cost savings while maintaining access to a broad network of providers.

- High Deductible Health Plans (HDHPs): These plans are designed for individuals who want lower premiums and are comfortable paying higher deductibles. HDHPs often come with a health savings account (HSA), allowing members to save pre-tax dollars for future medical expenses.

- Short-Term Health Insurance Plans: Ideal for temporary coverage needs, these plans provide limited benefits for a short duration, typically ranging from one to 12 months. They are a cost-effective solution for those in transition periods, such as job changes or waiting for employer-sponsored coverage to begin.

Each plan type comes with its own set of advantages and trade-offs. For instance, HMOs are budget-friendly but less flexible, while PPOs offer more freedom at a higher cost. By evaluating your healthcare needs, budget, and lifestyle, you can choose a Cigna plan that strikes the perfect balance between affordability and coverage.

Read also:Discovering Bea Arthurs Height A Comprehensive Look At Her Life And Legacy

What Are the Benefits of Choosing Cigna?

Opting for Cigna Health Insurance comes with a host of benefits that make it a standout choice for individuals and families seeking reliable healthcare coverage. One of the most significant advantages is Cigna’s extensive provider network, which includes top-rated doctors, hospitals, and specialists across the country. This ensures that members have access to high-quality care without the hassle of traveling long distances or paying exorbitant fees for out-of-network services. Additionally, Cigna’s global presence makes it an excellent option for frequent travelers or expatriates who need international coverage.

Another compelling benefit of Cigna is its focus on preventive care and wellness programs. Many of their plans offer free or low-cost preventive services, such as annual check-ups, vaccinations, and screenings, which help members maintain their health and catch potential issues early. Beyond traditional medical care, Cigna also provides wellness incentives, such as discounts on gym memberships, nutrition counseling, and stress management programs. These initiatives not only promote a healthier lifestyle but also reduce long-term healthcare costs by addressing health concerns proactively.

Cigna’s commitment to customer satisfaction is evident in its user-friendly tools and resources. For instance, their mobile app and online portal allow members to manage their plans, track claims, and access telemedicine services with ease. This level of convenience is particularly beneficial for those with busy schedules or limited access to in-person healthcare. Furthermore, Cigna’s 24/7 customer support ensures that members can resolve issues or get answers to their questions promptly. By combining affordability, accessibility, and innovation, Cigna Health Insurance offers a comprehensive solution that prioritizes both physical and financial well-being.

How to Choose the Right Cigna Health Insurance Plan?

Selecting the right Cigna Health Insurance plan can seem daunting, given the variety of options available. However, by evaluating your specific needs and priorities, you can narrow down the choices and find a plan that suits your lifestyle. Start by assessing your healthcare requirements. Do you frequently visit specialists, or are you generally healthy and only need coverage for emergencies? If you have ongoing medical conditions or anticipate significant healthcare expenses, a plan with lower out-of-pocket costs, such as a Health Maintenance Organization (HMO) or a High Deductible Health Plan (HDHP) paired with a Health Savings Account (HSA), may be ideal.

Next, consider your budget. Premiums, deductibles, and copayments vary significantly across Cigna’s plans, so it’s essential to strike a balance between affordability and coverage. For instance, Preferred Provider Organization (PPO) plans offer more flexibility but come with higher premiums, while Short-Term Health Insurance Plans provide temporary coverage at a lower cost. Additionally, think about your preferred healthcare providers. If you have a trusted doctor or hospital, ensure they are part of Cigna’s network to avoid unexpected expenses.

Finally, take advantage of Cigna’s online tools and resources to compare plans. Their website features detailed descriptions, cost estimators, and customer reviews to help you make an informed decision. If you’re still unsure, consider reaching out to a licensed insurance agent who can guide you through the selection process. By carefully evaluating your needs, budget, and preferences, you can choose a Cigna Health Insurance plan that provides peace of mind and comprehensive coverage.

Is Cigna Health Insurance Cost-Effective?

When evaluating the cost-effectiveness of Cigna Health Insurance, it’s important to consider both short-term affordability and long-term value. Cigna offers a range of plans designed to cater to different budgets, from budget-friendly options like Health Maintenance Organization (HMO) plans to more flexible but higher-cost Preferred Provider Organization (PPO) plans. While premiums and deductibles vary depending on the plan, Cigna’s emphasis on preventive care and wellness programs can lead to significant savings over time. For example, by covering routine check-ups and screenings at no additional cost, Cigna helps members avoid costly medical treatments that may arise from untreated conditions.

Another factor contributing to Cigna’s cost-effectiveness is its global network of healthcare providers. By partnering with in-network doctors and hospitals, Cigna ensures that members receive care at negotiated rates, reducing out-of-pocket expenses. Additionally, tools like cost estimators and health savings accounts (HSAs) empower policyholders to manage their healthcare spending efficiently. HSAs, in particular, allow members to save pre-tax dollars for future medical expenses, providing both immediate and long-term financial benefits.

While Cigna’s premiums may be slightly higher than some competitors, the comprehensive coverage and added benefits often justify the cost. For instance, features like telemedicine services and 24/7 customer support enhance convenience and reduce the need for costly in-person visits. By balancing affordability with quality care, Cigna Health Insurance proves to be a cost-effective solution for individuals and families seeking reliable healthcare coverage.

How Does Cigna Support