Ordering checks from Chase Bank is a straightforward process, yet many individuals find themselves unsure of where to start. Whether you’re a new account holder or someone who needs to reorder checks, Chase Bank offers multiple ways to get your checks delivered to your doorstep. The convenience of ordering checks online, through the mobile app, or even in-branch ensures that you have options tailored to your preferences. Understanding these methods not only saves time but also ensures accuracy in your financial transactions.

Chase Bank, one of the largest financial institutions in the United States, provides a seamless experience for its customers when it comes to managing their accounts and banking needs. Ordering checks is just one of the many services they offer, and it’s essential to know how to navigate this process efficiently. Whether you’re looking for personalized checks, standard checks, or even business checks, Chase has a variety of options to suit your requirements. By familiarizing yourself with the steps involved, you can avoid common pitfalls and ensure that your checks arrive on time.

In this article, we’ll walk you through everything you need to know about ordering checks from Chase Bank. From step-by-step instructions to frequently asked questions, this guide will equip you with the knowledge to make informed decisions. We’ll also explore additional tips to enhance your experience, including how to customize your checks and troubleshoot common issues. So, let’s dive in and uncover the details of this essential banking service.

Read also:What Is Peter Thiels Iq Score Unveiling The Genius Behind The Visionary

Table of Contents

- How to Order Checks Online from Chase Bank?

- Can You Order Checks via the Chase Mobile App?

- Ordering Checks In-Branch: Is It Worth It?

- Customizing Your Checks: What Are Your Options?

- How Long Does It Take to Receive Your Checks?

- Common Issues and Solutions When Ordering Checks

- What Is the Cost of Ordering Checks from Chase Bank?

- Frequently Asked Questions About Ordering Checks

How to Order Checks Online from Chase Bank?

Ordering checks online from Chase Bank is one of the most convenient methods available to customers. This process is designed to be user-friendly and efficient, ensuring that you can complete your order in just a few clicks. To begin, log in to your Chase Bank account through their official website. Once you’re logged in, navigate to the “Order Checks” section, which is typically found under the “Services” or “Account Tools” tab. From there, you’ll be prompted to select the type of checks you need, whether personal, business, or specialty checks.

After selecting the type of checks, you’ll have the option to customize them. Chase Bank offers a variety of designs, including standard templates, seasonal themes, and even custom images. If you’re ordering checks for the first time, you’ll need to provide your account and routing numbers, which can be found on your existing checks or in your account details. For returning customers, this information is usually pre-filled, saving you time. Additionally, you can specify the quantity of checks you need, whether it’s a single box or multiple boxes, depending on your usage.

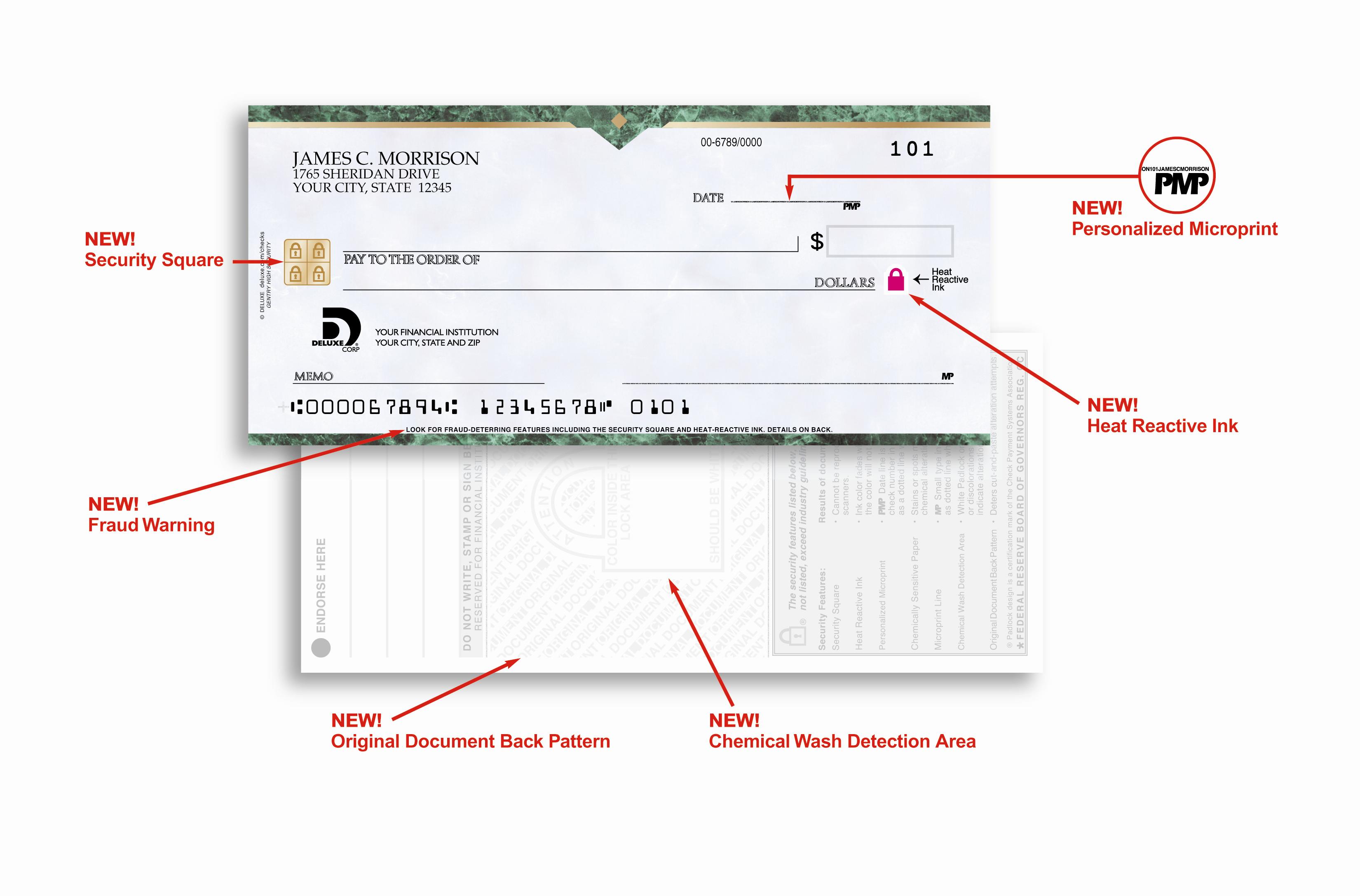

Once you’ve finalized your selection, proceed to the checkout page. Here, you’ll review your order details, including the total cost and estimated delivery time. Chase Bank partners with reputable check printing companies to ensure high-quality products, so you can trust that your checks will meet industry standards. After confirming your order, you’ll receive a confirmation email with tracking information, allowing you to monitor the status of your shipment. This seamless process makes ordering checks online a hassle-free experience for Chase Bank customers.

Can You Order Checks via the Chase Mobile App?

With the rise of mobile banking, many customers wonder, “Can I order checks directly through the Chase Mobile App?” The answer is yes! The Chase Mobile App is a powerful tool that allows users to manage their accounts, pay bills, deposit checks, and even order checks—all from the convenience of their smartphones. To get started, download the Chase Mobile App from your device’s app store and log in using your account credentials. Once logged in, navigate to the “Services” section, where you’ll find the option to order checks.

The process of ordering checks via the app mirrors the online experience. You’ll be guided through a series of steps to select the type of checks you need, customize their design, and specify the quantity. One of the standout features of using the mobile app is the ability to upload custom images for your checks, giving them a personal touch. Whether it’s a family photo, a scenic landscape, or a logo for your business, Chase Bank ensures that your checks reflect your unique style.

Another advantage of using the Chase Mobile App is the ability to track your order in real-time. After placing your order, you’ll receive notifications about the status of your shipment, ensuring that you’re always in the loop. Additionally, the app provides customer support options if you encounter any issues during the ordering process. With its intuitive interface and robust features, the Chase Mobile App is an excellent choice for those who prefer managing their banking needs on the go.

Read also:Kathy White Autopsy A Comprehensive Exploration Of The Case And Its Implications

Ordering Checks In-Branch: Is It Worth It?

While online and mobile options are increasingly popular, some customers still prefer the traditional method of ordering checks in-branch. If you’re wondering, “Is it worth ordering checks in person at a Chase Bank branch?” the answer depends on your preferences and circumstances. Visiting a branch allows you to speak directly with a representative who can guide you through the process and answer any questions you may have. This personalized assistance can be particularly helpful for first-time check orders or if you’re unsure about customization options.

When ordering checks in-branch, you’ll need to provide your account information, including your account and routing numbers. A Chase representative will assist you in selecting the type of checks you need and help you choose from the available designs. While this method may take longer than ordering online, it offers the advantage of face-to-face interaction, which can be reassuring for those who prefer a more hands-on approach.

However, there are a few drawbacks to consider. In-branch orders may take longer to process, and you might not have access to the same range of customization options as you would online. Additionally, visiting a branch requires time and effort, which may not be ideal for busy individuals. Ultimately, the decision to order checks in-branch depends on your comfort level and the level of assistance you require.

Customizing Your Checks: What Are Your Options?

What Types of Designs Are Available?

When ordering checks from Chase Bank, one of the most exciting aspects is the ability to customize their appearance. Chase offers a wide range of design options to suit various tastes and preferences. Standard designs include classic patterns, elegant borders, and minimalist layouts. For those who want something more unique, seasonal themes like holidays, nature-inspired motifs, and artistic patterns are also available. These designs allow you to express your personality while maintaining professionalism in your financial transactions.

Can You Add Personal Images or Logos?

Yes, Chase Bank allows customers to upload personal images or logos for their checks. This feature is particularly popular for business checks, as it enables companies to incorporate their branding into their financial documents. For personal checks, you can upload family photos, travel snapshots, or any image that holds significance to you. Chase ensures that all uploaded images meet quality and security standards, so your checks remain both visually appealing and functional.

In addition to design options, you can also choose from various fonts, colors, and layouts to further personalize your checks. Whether you’re looking for a sleek and modern look or a more traditional aesthetic, Chase Bank provides the tools to create checks that align with your preferences. By taking advantage of these customization options, you can make your checks stand out while ensuring they meet your practical needs.

How Long Does It Take to Receive Your Checks?

One of the most common questions customers ask is, “How long does it take to receive checks after ordering them from Chase Bank?” The answer depends on several factors, including the method of ordering, the type of checks selected, and the shipping option chosen. On average, standard orders take about 7 to 10 business days to arrive. However, expedited shipping options are available for those who need their checks sooner, often delivering within 3 to 5 business days.

When ordering online or via the mobile app, you’ll receive an estimated delivery date during the checkout process. This date takes into account the time required for processing, printing, and shipping. If you’re ordering in-branch, the timeline may vary slightly, as the representative will need to submit your order to the check printing service. Regardless of the method, Chase Bank ensures that customers receive tracking information, allowing them to monitor the status of their shipment.

It’s important to plan ahead and place your order well in advance to avoid running out of checks. If you’re a new account holder or anticipate needing checks for an upcoming event, consider ordering them as soon as possible. By understanding the delivery timeline, you can ensure that your checks arrive on time and without any inconvenience.

Common Issues and Solutions When Ordering Checks

What Should You Do If Your Order Is Delayed?

While Chase Bank strives to deliver checks promptly, delays can occasionally occur due to unforeseen circumstances. If your order is delayed, the first step is to check the tracking information provided in your confirmation email. This will give you an updated delivery estimate and help you determine whether the delay is due to shipping or processing issues. If the tracking information doesn’t provide clarity, contact Chase Bank’s customer support team for assistance.

How Can You Resolve Errors in Your Check Details?

Mistakes in check details, such as incorrect account numbers or misspelled names, can be frustrating. If you notice an error after receiving your checks, contact Chase Bank immediately to report the issue. They will guide you through the process of returning the incorrect checks and reordering them at no additional cost. To prevent errors, always double-check your order details before submitting them, especially when entering account information manually.

Other common issues include problems with custom images or designs. If your uploaded image doesn’t meet quality standards, Chase Bank will notify you and provide guidance on resolving the issue. By addressing these problems promptly, you can ensure that your checks are accurate and ready for use.

What Is the Cost of Ordering Checks from Chase Bank?

The cost of ordering checks from Chase Bank varies depending on the type of checks, the quantity ordered, and any additional customization options. Standard personal checks typically range from $15 to $30 per box, while business checks may be slightly more expensive due to their specialized design and features. Customization options, such as adding personal images or logos, may incur additional fees, so it’s important to review the pricing details before finalizing your order.

Chase Bank frequently offers promotions and discounts for check orders, especially for new customers or those reordering checks. These promotions can significantly reduce the overall cost, making it more affordable to personalize your checks. Additionally, Chase partners with reputable check printing companies that offer high-quality products at competitive prices, ensuring that you receive excellent value for your money.

To manage costs effectively, consider ordering multiple boxes of checks at once, as this often results in a lower per-box price. Keep in mind that shipping fees may apply, especially for expedited orders. By understanding the pricing structure and taking advantage of available discounts, you can make informed decisions about your check orders.

Frequently Asked Questions About Ordering Checks

Can I Order Checks Without an Existing Account at Chase Bank?

No, you must have an active account with Chase Bank to order checks through their services. This ensures that the checks are linked to your account and can be used for transactions.

Are There Any Restrictions on Custom Images for Checks?

Yes, Chase Bank has guidelines for custom images to ensure they meet quality and security standards. Images must be clear, high-resolution, and free of inappropriate content. If your image doesn’t meet these criteria, Chase will notify you and provide guidance on making adjustments.

What Should I Do If I Run Out of Checks Before My Order Arrives?

If you’re in urgent need of checks, consider using Chase Bank’s mobile check deposit feature or requesting a temporary check from your local branch. This will allow you to continue managing your finances until your new checks arrive.

In conclusion, ordering checks from Chase Bank is a simple and flexible process that caters to a variety of customer needs. Whether you choose to order online, via the mobile app, or in-branch, Chase provides the tools and support to ensure a seamless experience. By understanding the options available and addressing common issues, you can make the most of this essential banking service. For more information, visit Chase Bank’s official website or contact their customer support team.