Quitt net is a game-changing platform that has transformed the way businesses handle their financial transactions. Whether you're a small startup or a large enterprise, the ability to streamline payments and manage cash flow efficiently is crucial for success. Quitt net offers a seamless solution that simplifies these processes while ensuring security and reliability. By leveraging advanced technology, this platform has become a trusted tool for businesses looking to optimize their financial operations. With its user-friendly interface and robust features, quitt net is designed to cater to the needs of modern businesses that demand efficiency and transparency in their day-to-day operations.

In today’s fast-paced digital world, businesses are constantly seeking innovative solutions to stay competitive. Quitt net stands out as a reliable option that not only meets but exceeds these expectations. From automating invoice payments to providing real-time transaction tracking, this platform offers a comprehensive suite of tools that can significantly reduce manual workload and minimize errors. The platform's emphasis on security ensures that sensitive financial data is protected, giving users peace of mind while conducting transactions.

As more businesses adopt digital tools to manage their operations, quitt net has emerged as a leader in the financial technology space. Its ability to integrate with existing systems and scale according to business needs makes it a versatile choice for organizations of all sizes. With features like automated reminders, customizable payment schedules, and detailed reporting, quitt net empowers businesses to take control of their finances and focus on growth. In the following sections, we’ll explore how quitt net works, its benefits, and why it might be the perfect solution for your business.

Read also:Does Drew Carey Have Any Children Discover The Truth About His Family Life

Table of Contents

- What is Quitt Net?

- How Does Quitt Net Work?

- Why Should You Use Quitt Net?

- Is Quitt Net Secure?

- How Can Quitt Net Benefit Small Businesses?

- What Are the Key Features of Quitt Net?

- How to Get Started with Quitt Net?

- Frequently Asked Questions About Quitt Net

What is Quitt Net?

Quitt net is an innovative financial platform designed to simplify and streamline payment processes for businesses. It serves as a bridge between companies and their financial obligations, offering tools that automate invoicing, payment tracking, and cash flow management. By integrating advanced technology with user-friendly features, quitt net has become a go-to solution for organizations looking to enhance their operational efficiency. The platform caters to a wide range of industries, from retail to manufacturing, and is particularly beneficial for businesses that deal with high volumes of transactions.

One of the standout aspects of quitt net is its ability to integrate seamlessly with existing accounting systems. This ensures that businesses don’t need to overhaul their current processes to adopt the platform. Instead, quitt net works in the background, automating repetitive tasks and reducing the risk of human error. For instance, businesses can set up automated payment reminders, schedule recurring invoices, and generate detailed financial reports with just a few clicks. This level of automation not only saves time but also allows businesses to allocate resources more effectively.

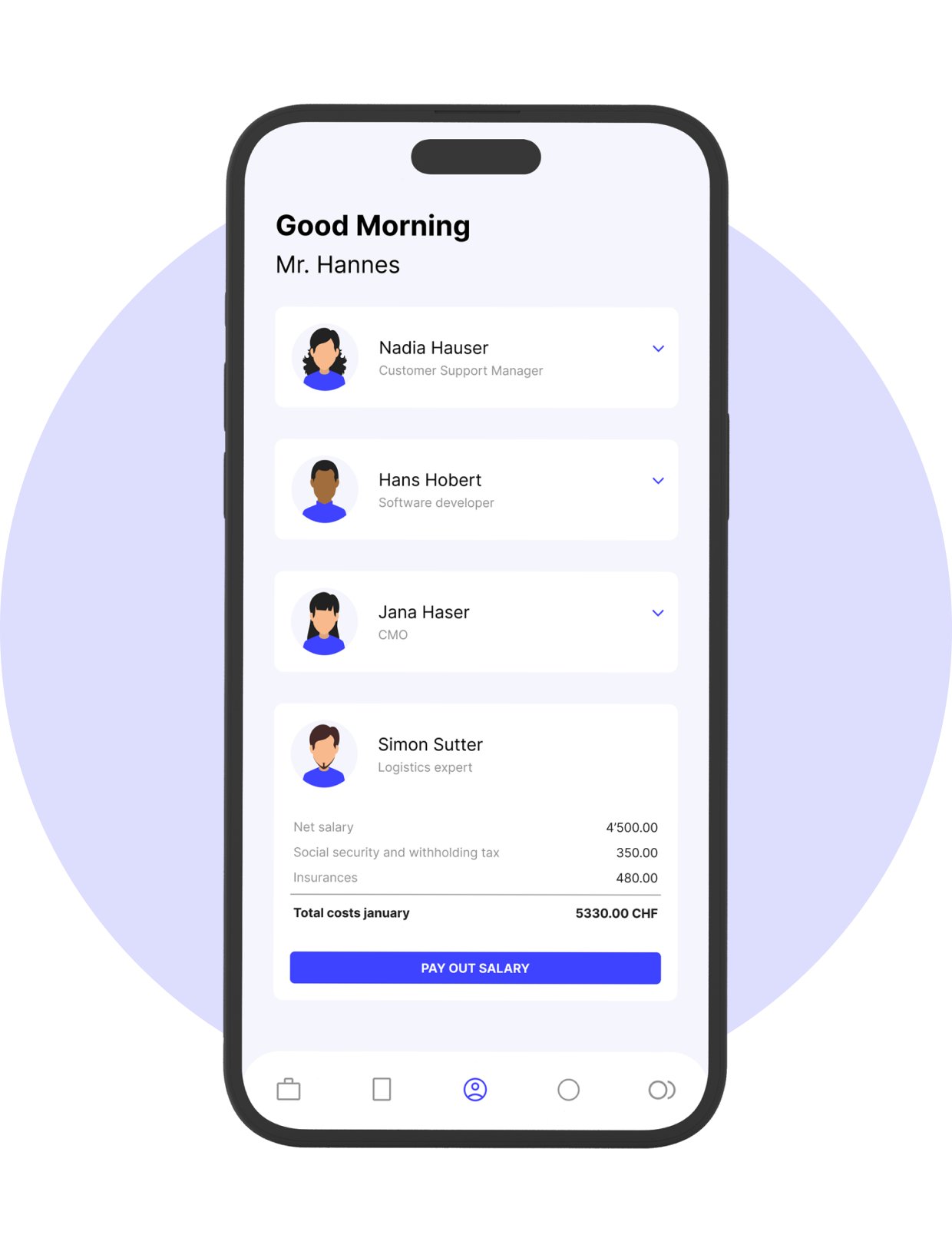

Quitt net also emphasizes accessibility, offering a cloud-based solution that can be accessed from anywhere with an internet connection. This is particularly useful for businesses with remote teams or multiple locations. Whether you’re managing finances from your office or on the go, quitt net ensures that you have real-time access to your financial data. Additionally, the platform’s intuitive dashboard provides a clear overview of your financial health, helping you make informed decisions quickly and efficiently.

How Does Quitt Net Work?

Understanding how quitt net operates is essential for businesses considering its adoption. At its core, quitt net functions as a centralized hub for managing financial transactions. Users can upload invoices, track payments, and generate reports through a single interface. The platform uses advanced algorithms to process transactions quickly and accurately, ensuring that businesses can rely on it for their day-to-day operations.

Step 1: Setting Up Your Account

The first step in using quitt net is creating an account. This process is straightforward and involves providing basic business information, such as your company name, address, and tax identification number. Once your account is set up, you can begin integrating quitt net with your existing accounting software. The platform supports a wide range of integrations, including popular tools like QuickBooks and Xero, making it easy to sync your data.

Step 2: Automating Invoices and Payments

After setting up your account, you can start automating your invoicing and payment processes. Quitt net allows you to create custom invoice templates, schedule recurring payments, and send automated reminders to clients. This feature is particularly useful for businesses that deal with multiple clients and need to ensure timely payments. By automating these tasks, quitt net reduces the administrative burden on your team, allowing them to focus on more strategic activities.

Read also:Hannah Waddingham Playboy Unveiling Her Journey Achievements And More

Step 3: Monitoring Financial Health

One of the most valuable aspects of quitt net is its ability to provide real-time insights into your financial health. The platform generates detailed reports that highlight key metrics, such as cash flow, outstanding invoices, and payment trends. These reports can be customized to suit your specific needs and exported for further analysis. By leveraging this data, businesses can make informed decisions that drive growth and improve profitability.

Why Should You Use Quitt Net?

Quitt net offers a wide range of benefits that make it an attractive option for businesses of all sizes. From improving efficiency to enhancing security, the platform provides tools that address common pain points in financial management. Below, we explore some of the key reasons why businesses should consider adopting quitt net.

Increased Efficiency and Productivity

One of the primary advantages of using quitt net is the significant boost in efficiency it provides. By automating repetitive tasks like invoicing and payment tracking, the platform frees up valuable time for your team. This allows them to focus on more strategic activities, such as business development and customer relationship management. Additionally, quitt net’s cloud-based nature ensures that your team can collaborate seamlessly, regardless of their location.

Enhanced Security and Reliability

Security is a top priority for any financial platform, and quitt net excels in this area. The platform uses advanced encryption protocols to protect sensitive data, ensuring that your financial information remains secure at all times. Furthermore, quitt net undergoes regular audits and updates to maintain its reliability and compliance with industry standards. This level of security gives businesses peace of mind, knowing that their transactions are protected from potential threats.

Cost Savings and Scalability

Another compelling reason to use quitt net is its cost-effectiveness. By automating manual processes, businesses can reduce labor costs and minimize errors that could lead to financial losses. Additionally, quitt net’s scalable nature ensures that it can grow with your business. Whether you’re a small startup or a large enterprise, the platform can adapt to meet your evolving needs without requiring significant investments in new infrastructure.

Is Quitt Net Secure?

When it comes to financial platforms, security is a critical concern for businesses. Quitt net addresses this issue by implementing a multi-layered security framework that protects user data and ensures the integrity of transactions. The platform uses industry-standard encryption protocols to safeguard sensitive information, such as bank account details and transaction histories. Additionally, quitt net employs advanced fraud detection mechanisms to identify and prevent suspicious activities.

How Does Quitt Net Protect Your Data?

Quitt net’s security measures begin with data encryption, which ensures that all information transmitted through the platform is protected from unauthorized access. The platform also uses secure servers to store data, further reducing the risk of breaches. In addition to these technical safeguards, quitt net provides users with tools to manage their security settings, such as two-factor authentication and access controls. These features give businesses greater control over who can access their financial data and under what circumstances.

What Are the Compliance Standards of Quitt Net?

Quitt net adheres to strict compliance standards to ensure that it meets the regulatory requirements of various industries. The platform is compliant with standards such as PCI DSS (Payment Card Industry Data Security Standard) and GDPR (General Data Protection Regulation), which govern the handling of financial and personal data. By maintaining these certifications, quitt net demonstrates its commitment to providing a secure and reliable service that businesses can trust.

How Can Quitt Net Benefit Small Businesses?

Small businesses often face unique challenges when it comes to managing their finances. Limited resources, tight budgets, and a lack of specialized staff can make it difficult to handle financial operations efficiently. Quitt net offers a solution that addresses these challenges by providing tools that are both affordable and easy to use. Below, we explore how quitt net can specifically benefit small businesses.

Streamlined Financial Management

For small businesses, managing finances can be a time-consuming and error-prone process. Quitt net simplifies this by automating tasks like invoicing, payment tracking, and reporting. This not only saves time but also reduces the risk of mistakes that could lead to financial losses. Additionally, the platform’s intuitive interface ensures that even users with limited technical expertise can navigate it with ease.

Improved Cash Flow

Cash flow management is a critical aspect of running a small business, and quitt net excels in this area. The platform provides real-time insights into your financial health, helping you identify potential cash flow issues before they become problematic. By automating payment reminders and scheduling recurring invoices, quitt net ensures that you receive payments on time, improving your overall cash flow.

Cost-Effective Solution

One of the standout benefits of quitt net for small businesses is its affordability. Unlike traditional financial management tools, which can be expensive and complex, quitt net offers a cost-effective solution that delivers significant value. The platform’s pay-as-you-go pricing model ensures that you only pay for the features you need, making it an ideal choice for businesses with limited budgets.

What Are the Key Features of Quitt Net?

Quitt net is packed with features that make it a versatile and powerful tool for businesses. From automation to reporting, the platform offers a wide range of capabilities that address various aspects of financial management. Below, we highlight some of the key features that set quitt net apart from its competitors.

Automated Invoicing and Payment Reminders

One of the standout features of quitt net is its ability to automate invoicing and payment reminders. This ensures that businesses can maintain a steady cash flow without having to manually track payments. By setting up recurring invoices and automated reminders, businesses can reduce the administrative burden on their teams and focus on more strategic activities.

Real-Time Financial Reporting

Quitt net provides businesses with real-time financial reporting capabilities, allowing them to monitor their financial health at a glance. The platform generates detailed reports that highlight key metrics, such as cash flow, outstanding invoices, and payment trends. These reports can be customized to suit specific needs and exported for further analysis, helping businesses make informed decisions that drive growth.

Integration with Existing Systems

Another key feature of quitt net is its ability to integrate with existing accounting systems. This ensures that businesses don’t need to overhaul their current processes to adopt the platform. Quitt net supports a wide range of integrations, including popular tools like QuickBooks and Xero, making it easy to sync data and streamline operations.

How to Get Started with Quitt Net?

Getting started with quitt net is a straightforward process that can be completed in just a few steps. Below, we outline the key steps you need to follow to begin using the platform.

Step 1: Create an Account

The first step is to create an account on quitt net. This involves providing basic business information, such as your company name, address, and tax identification number. Once your account is set up, you can begin integrating the platform with your existing systems.

Step 2: Set Up Automation

After creating your account, the next step is to set up automation for your invoicing and payment processes. Quitt net allows you to create custom invoice templates, schedule recurring payments, and send automated reminders to clients. This ensures that your financial operations run smoothly without requiring manual intervention.

Step 3: Monitor Your Financial Health

Finally, you can begin monitoring your financial health using quitt net’s reporting tools. The platform provides real-time insights into key metrics, such as cash flow and outstanding invoices, helping you make informed decisions that drive growth and improve profitability.