Trusted community banking is more than just a financial institution; it’s a cornerstone of local economies and a lifeline for individuals and businesses alike. These banks are deeply rooted in the communities they serve, prioritizing personalized service, transparency, and trust. Unlike large corporate banks, community banks focus on fostering long-term relationships with their customers, ensuring that their financial needs are met with care and precision. With their commitment to local development and ethical practices, trusted community banking has become a beacon of hope for those seeking stability in an ever-changing financial landscape.

Over the years, trusted community banking has evolved to meet the unique challenges faced by individuals and small businesses. By offering tailored financial solutions, these institutions empower their customers to achieve their goals, whether it’s buying a home, starting a business, or saving for the future. Their localized approach allows them to understand the specific needs of their community, ensuring that their services are both relevant and impactful. This personalized touch is what sets trusted community banking apart from larger financial institutions.

As we delve deeper into the world of trusted community banking, we’ll explore how these institutions operate, the benefits they offer, and why they are essential for building strong, resilient communities. From their role in supporting local economies to their commitment to ethical practices, trusted community banking is a vital component of financial well-being. Let’s uncover the many facets of this invaluable service and understand why it deserves your trust and support.

Read also:Unveiling The Truth Patrick Swayzes Son Jason Whittle Dna Results Explained

Table of Contents

- What Makes Trusted Community Banking Different?

- How Does Trusted Community Banking Support Local Economies?

- Why Should You Choose Trusted Community Banking Over Corporate Banks?

- What Are the Key Benefits of Trusted Community Banking?

- How Can Trusted Community Banking Help Small Businesses Thrive?

- What Role Does Technology Play in Modern Community Banking?

- Is Trusted Community Banking the Right Choice for You?

- Frequently Asked Questions About Trusted Community Banking

What Makes Trusted Community Banking Different?

Trusted community banking stands out from corporate banking models due to its localized focus and customer-centric approach. Unlike large banks that often prioritize profits over people, community banks are deeply embedded in the areas they serve. They understand the unique challenges and opportunities within their communities, allowing them to provide tailored financial solutions. For instance, a trusted community banking institution might offer specialized loan programs for local farmers or small businesses, recognizing the specific needs of these groups.

Another key difference is the emphasis on relationship banking. Trusted community banking thrives on building long-term connections with customers. Instead of treating clients as mere account numbers, community bankers often know their customers by name and understand their financial goals. This personal touch fosters trust and loyalty, creating a banking experience that feels more like a partnership than a transaction. Additionally, community banks are more likely to reinvest deposits back into the local economy, funding projects like infrastructure development, education, and affordable housing.

Trusted community banking also prioritizes ethical practices and transparency. Customers can expect clear communication about fees, interest rates, and loan terms, ensuring they make informed decisions. This commitment to integrity not only strengthens the bank’s reputation but also contributes to the overall well-being of the community. By choosing trusted community banking, individuals and businesses can rest assured that their financial needs are being met with honesty and care.

How Does Trusted Community Banking Support Local Economies?

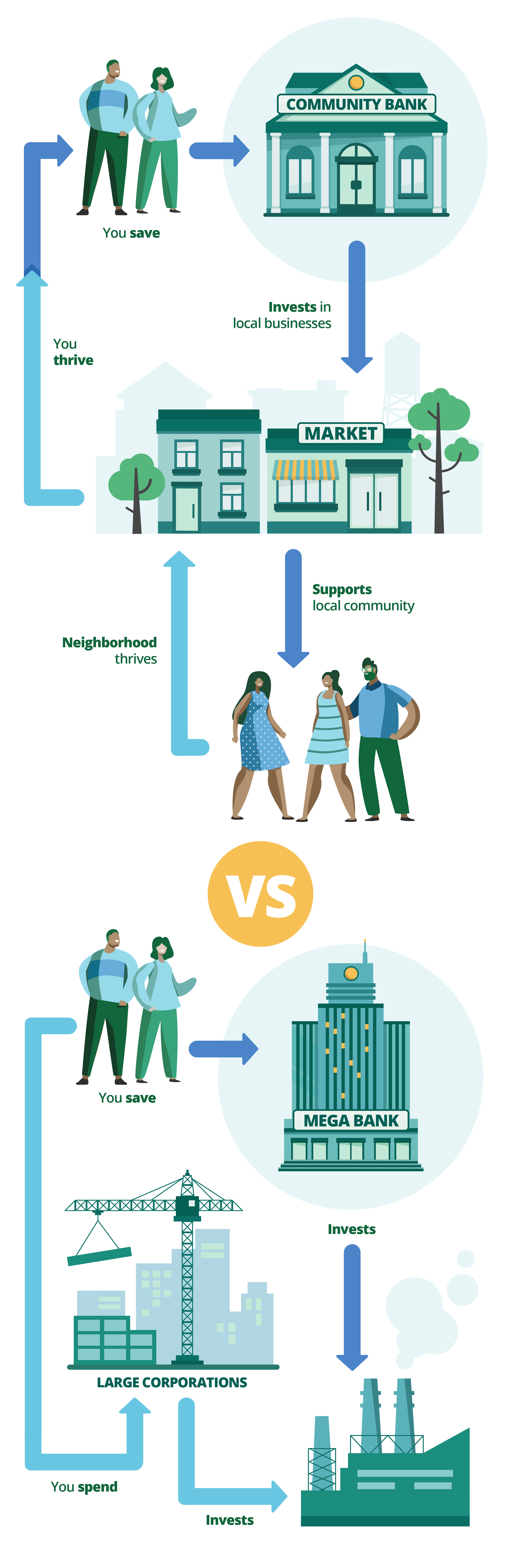

Trusted community banking plays a pivotal role in bolstering local economies by channeling resources directly into the areas they serve. When you deposit money in a community bank, your funds are more likely to be reinvested locally. For example, these banks often provide loans to small businesses, enabling them to expand operations, hire employees, and contribute to economic growth. This cycle of investment creates a ripple effect, benefiting not only the business owners but also the entire community.

Moreover, trusted community banking institutions often collaborate with local governments and organizations to fund community development projects. These initiatives might include building affordable housing, improving public infrastructure, or supporting educational programs. By prioritizing such projects, community banks help address critical needs while fostering long-term economic resilience. For instance, a community bank might partner with a nonprofit to provide financial literacy workshops, empowering residents to make smarter financial decisions.

Another way trusted community banking supports local economies is by promoting entrepreneurship. Many community banks offer specialized programs to assist startups and small businesses, such as low-interest loans or mentorship opportunities. These resources are invaluable for entrepreneurs who may struggle to secure funding from larger financial institutions. By nurturing local talent and innovation, trusted community banking helps create a vibrant, self-sustaining economy that benefits everyone.

Read also:Discovering The Impact Of 5 Foot Tall Actresses In Hollywood

Why Should You Choose Trusted Community Banking Over Corporate Banks?

Choosing trusted community banking over corporate banks offers numerous advantages, particularly for those who value personalized service and community impact. One of the most compelling reasons is the level of customer care provided by community banks. Unlike corporate banks, which often rely on automated systems and impersonal interactions, trusted community banking focuses on building genuine relationships. Whether you’re opening a savings account or applying for a mortgage, you’ll likely work with the same banker throughout the process, ensuring consistency and trust.

Another significant benefit is the localized decision-making process. Corporate banks often have rigid policies dictated by distant headquarters, leaving little room for flexibility. In contrast, trusted community banking allows local branch managers to make decisions based on the unique circumstances of their customers. This adaptability is particularly valuable for small businesses or individuals with unconventional financial needs, as it increases the likelihood of loan approvals and favorable terms.

Finally, trusted community banking contributes directly to the local economy, creating a sense of shared prosperity. When you bank locally, your money supports community projects, job creation, and small businesses, fostering a stronger, more resilient economy. In contrast, corporate banks often channel funds to large-scale projects or investments that may not benefit your immediate community. By choosing trusted community banking, you’re not just managing your finances—you’re making a meaningful impact on the world around you.

What Are the Key Benefits of Trusted Community Banking?

Personalized Service and Relationship Building

One of the standout benefits of trusted community banking is the emphasis on personalized service. Community banks pride themselves on knowing their customers by name and understanding their unique financial situations. This personal touch extends beyond mere transactions; it’s about building lasting relationships. For example, a trusted community banking representative might take the time to review your financial goals and offer tailored advice, such as creating a savings plan or exploring investment opportunities. This level of care is rarely found in larger banks, where customers often feel like just another number.

Additionally, trusted community banking fosters a sense of belonging. Many customers appreciate the familiarity of walking into a branch and being greeted by a friendly face who knows their history. This human connection not only enhances the banking experience but also builds trust. When customers feel valued, they’re more likely to remain loyal to the institution, creating a mutually beneficial relationship. Trusted community banking thrives on this foundation of trust and reliability, making it a preferred choice for those seeking a more personal approach to banking.

Community Investment and Development

Trusted community banking is deeply committed to investing in the areas it serves. Unlike corporate banks, which may allocate resources to global or national projects, community banks prioritize local initiatives. For instance, they often provide funding for affordable housing developments, infrastructure improvements, and educational programs. These investments not only address immediate needs but also lay the groundwork for long-term prosperity.

Another way trusted community banking supports development is by partnering with local nonprofits and organizations. These collaborations often focus on initiatives like financial literacy programs, job training, and entrepreneurship support. By empowering residents with the tools and knowledge they need to succeed, community banks help create a more resilient and self-sufficient community. This commitment to local investment underscores the value of trusted community banking as a force for positive change.

How Can Trusted Community Banking Help Small Businesses Thrive?

Small businesses are the backbone of local economies, and trusted community banking plays a crucial role in their success. These banks understand the challenges faced by entrepreneurs, such as securing startup capital or managing cash flow. By offering specialized loan programs and flexible terms, trusted community banking provides the financial support small businesses need to grow and thrive. For example, a community bank might offer a low-interest loan to a local bakery looking to expand its operations or renovate its storefront.

Trusted community banking also offers personalized advice and mentorship to small business owners. Bankers often act as financial advisors, helping entrepreneurs navigate complex decisions like budgeting, tax planning, and investment strategies. This guidance is invaluable for small business owners who may lack access to professional financial consultants. Additionally, community banks often host networking events or workshops, connecting local entrepreneurs with resources and opportunities to collaborate.

Finally, trusted community banking fosters a sense of partnership with small businesses. By investing in local enterprises, these banks demonstrate their commitment to shared success. This collaboration not only benefits the businesses themselves but also strengthens the community as a whole. When small businesses thrive, they create jobs, stimulate economic growth, and enhance the quality of life for residents. Trusted community banking is a vital ally in this process, ensuring that local entrepreneurs have the tools and support they need to succeed.

What Role Does Technology Play in Modern Community Banking?

While trusted community banking is known for its personal touch, technology has become an essential tool in enhancing its services. Modern community banks leverage digital platforms to provide convenience without sacrificing the human connection that sets them apart. For instance, many trusted community banking institutions now offer mobile banking apps, allowing customers to check balances, transfer funds, and pay bills from their smartphones. These innovations ensure that customers can access their accounts anytime, anywhere, while still enjoying the personalized service they expect.

Technology also enables trusted community banking to streamline operations and improve efficiency. For example, automated loan processing systems can expedite approvals, reducing wait times for customers. At the same time, data analytics tools help banks better understand customer needs, allowing them to offer more targeted financial products and services. Despite these advancements, community banks remain committed to maintaining a human touch, ensuring that technology complements rather than replaces personal interactions.

Finally, trusted community banking uses technology to enhance security and transparency. Features like two-factor authentication and real-time fraud monitoring protect customers’ accounts, while online portals provide clear, detailed information about fees and transactions. By embracing technology responsibly, community banks can continue to deliver exceptional service while staying competitive in an increasingly digital world.

Is Trusted Community Banking the Right Choice for You?

If you’re considering switching to a trusted community banking institution, it’s important to evaluate whether it aligns with your financial goals and values. For individuals who prioritize personalized service, ethical practices, and community impact, trusted community banking is an excellent choice. These banks offer a level of care and attention that larger institutions often lack, ensuring that your financial needs are met with integrity and transparency.

Trusted community banking is also ideal for those who want to support local economies. By banking locally, you contribute to the growth and development of your community, whether through funding small businesses, supporting infrastructure projects, or participating in financial literacy programs. This sense of shared purpose can be incredibly rewarding, as it allows you to make a tangible difference in the world around you.

However, it’s worth noting that trusted community banking may not offer the same range of services as larger banks, such as international banking or specialized investment products. If these services are essential to your financial strategy, you may need to weigh the pros and cons carefully. Ultimately, the decision comes down to what matters most to you—whether it’s personalized service, community impact, or access to a broader array of financial tools.

Frequently Asked Questions About Trusted Community Banking

What is the main advantage of trusted community banking?

The main advantage of trusted community banking is its focus on personalized service and community impact. Unlike larger banks, community banks prioritize building relationships with their customers and reinvesting in local economies. This approach fosters trust, loyalty, and a