Postal orders have long been a reliable and secure way to transfer money through the postal system. They function as a prepaid financial instrument, allowing individuals to send funds safely without the need for cash or checks. Often compared to money orders, postal orders are issued by postal authorities and can be used for a variety of transactions, from paying bills to sending gifts. Their convenience and reliability have made them a popular choice for people who need a secure method of payment that doesn't involve banks or digital platforms. Whether you're unfamiliar with postal orders or simply looking to understand their uses better, this guide will provide all the information you need to make informed decisions.

Postal orders are especially useful for those who don't have access to traditional banking services or prefer not to share their banking details online. Unlike cash, postal orders can be tracked and replaced if lost or stolen, offering peace of mind to both senders and recipients. They are also widely accepted by businesses, government agencies, and individuals, making them a versatile tool for financial transactions. In a world increasingly dominated by digital payments, postal orders remain a trusted option for those who value security and simplicity.

Despite the rise of online payment systems, postal orders continue to hold their ground as a dependable method of transferring funds. Their affordability, ease of use, and widespread acceptance make them an attractive choice for a variety of situations. From paying utility bills to sending money to family members, postal orders provide a tangible and reliable alternative to modern payment methods. This article will explore everything you need to know about postal orders, from their history and benefits to practical tips on how to use them effectively.

Read also:Who Is Jeff Garcias Wife Everything You Need To Know About Her Life And Relationship

Table of Contents

- What Are Postal Orders and How Do They Work?

- Why Should You Use Postal Orders Instead of Other Payment Methods?

- How to Purchase and Use Postal Orders Effectively

- Are Postal Orders Safe and Secure for Financial Transactions?

- What Are the Advantages and Disadvantages of Postal Orders?

- Can Postal Orders Be Traced or Replaced If Lost?

- How Do Postal Orders Compare to Money Orders and Bank Transfers?

- Frequently Asked Questions About Postal Orders

What Are Postal Orders and How Do They Work?

Postal orders are essentially prepaid financial instruments issued by postal authorities. They allow individuals to send a specific amount of money securely through the mail. The sender purchases a postal order for the desired amount, pays a small fee, and then sends the document to the recipient. Once the recipient receives the postal order, they can cash it at a post office or deposit it into their bank account.

One of the key features of postal orders is that they are prepaid, meaning the sender must pay the full amount upfront. This eliminates the risk of bounced checks or insufficient funds. Additionally, postal orders often include a unique serial number, which allows them to be traced if lost or stolen. This feature makes them a secure option for sending money, especially in situations where cash or checks might be vulnerable to theft or fraud.

Postal orders are widely accepted by businesses, government agencies, and individuals. They can be used to pay bills, settle debts, or send money to family and friends. Unlike cash, postal orders provide a paper trail, making them a preferred choice for transactions that require documentation or proof of payment. Their affordability and ease of use make them a practical solution for those who need a reliable method of transferring funds.

Why Should You Use Postal Orders Instead of Other Payment Methods?

When it comes to choosing a payment method, postal orders offer several advantages over other options like cash, checks, or digital payments. One of the primary reasons to use postal orders is their security. Unlike cash, which can be easily lost or stolen, postal orders are traceable and can be replaced if necessary. This makes them an ideal choice for sending money through the mail or for transactions where security is a concern.

Another benefit of postal orders is their accessibility. Not everyone has access to a bank account or feels comfortable using digital payment platforms. Postal orders provide a simple and straightforward way to transfer funds without the need for a bank account or internet access. They are also widely accepted by businesses and government agencies, making them a versatile option for a variety of transactions.

Postal orders are also cost-effective. The fees associated with purchasing a postal order are typically much lower than those charged by money transfer services or banks. This makes them an affordable option for individuals who need to send money but want to avoid high transaction fees. Additionally, postal orders are easy to use and don't require any special knowledge or technical skills, making them accessible to people of all ages and backgrounds.

Read also:Jimmy O Yang Girlfriend Everything You Need To Know About His Love Life

How to Purchase and Use Postal Orders Effectively

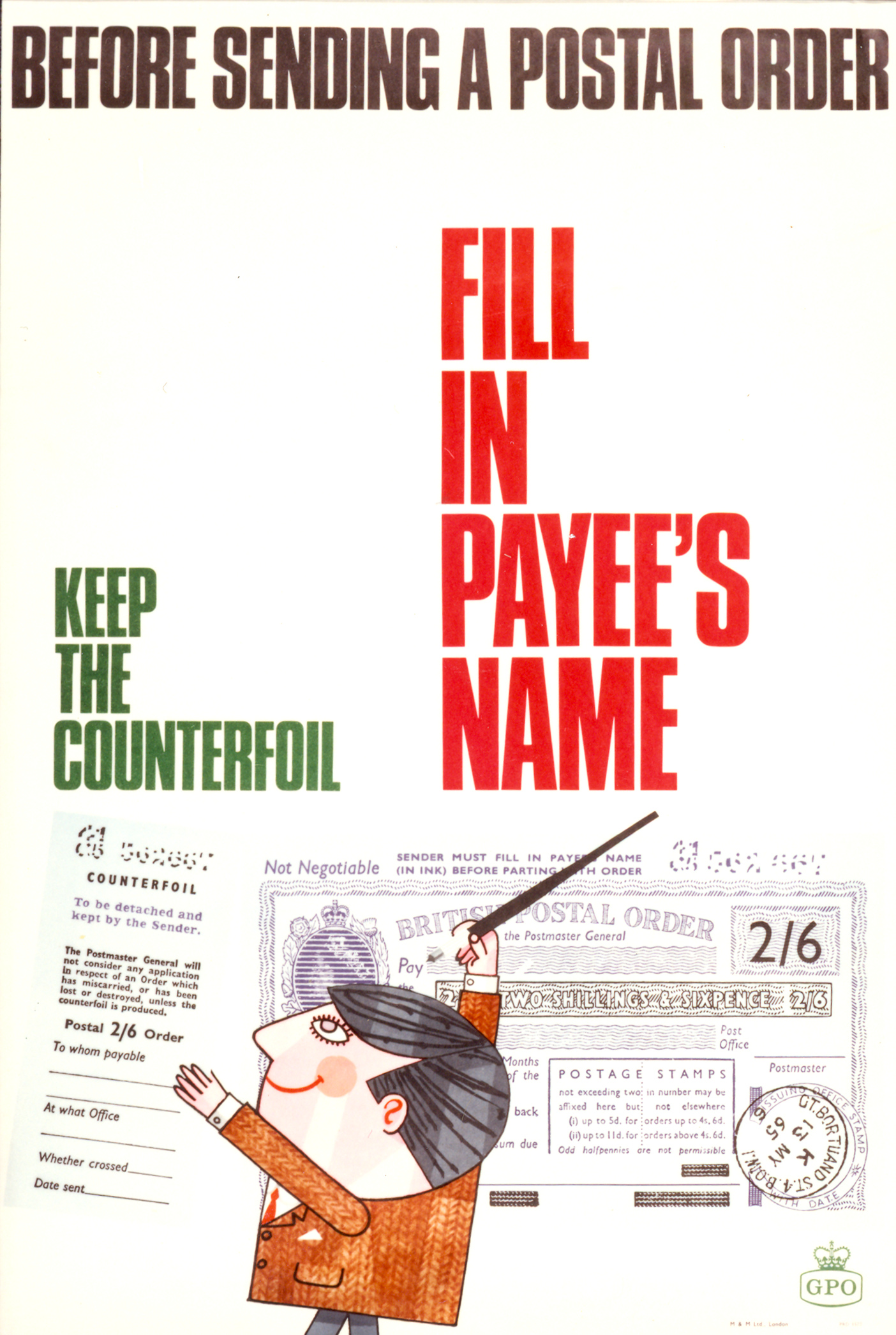

Purchasing and using postal orders is a straightforward process that can be completed in just a few simple steps. To begin, visit your local post office and request a postal order for the desired amount. You will need to pay the full amount upfront, along with a small fee, which varies depending on the amount of the postal order. Once the postal order has been issued, it will include a unique serial number and the name of the payee, if specified.

After purchasing the postal order, you can send it to the recipient via mail or deliver it in person. It's important to keep the receipt and any documentation provided by the post office, as these will be needed if the postal order is lost or stolen. The recipient can then cash the postal order at any post office or deposit it into their bank account, depending on their preference.

To use postal orders effectively, it's important to follow a few best practices. First, always specify the name of the payee when purchasing the postal order. This adds an extra layer of security and ensures that only the intended recipient can cash it. Second, keep a record of the serial number and other details in case the postal order is lost or stolen. Finally, be aware of any fees associated with cashing or depositing the postal order, as these can vary depending on the post office or financial institution.

Are Postal Orders Safe and Secure for Financial Transactions?

One of the most common concerns when it comes to financial transactions is security. Postal orders are widely regarded as a safe and secure method of transferring funds, thanks to their prepaid nature and traceability. Unlike cash, which can be easily lost or stolen, postal orders include a unique serial number that allows them to be tracked and replaced if necessary. This feature provides peace of mind to both senders and recipients, knowing that their money is protected.

Another factor that contributes to the security of postal orders is their acceptance by reputable institutions. Postal orders are issued by postal authorities, which are government-regulated entities. This ensures that they meet strict standards for security and reliability. Additionally, postal orders can only be cashed by the named payee, further reducing the risk of fraud or unauthorized use.

While postal orders are generally considered safe, it's important to take precautions to protect them. Always keep the receipt and any documentation provided by the post office, as these will be needed if the postal order is lost or stolen. Additionally, avoid sending postal orders through unsecured mail services, and consider using registered or insured mail for added protection. By following these best practices, you can ensure that your postal orders remain secure throughout the transaction process.

What Are the Advantages and Disadvantages of Postal Orders?

Advantages of Using Postal Orders

Postal orders offer several advantages that make them a popular choice for financial transactions. One of the key benefits is their security. Unlike cash, postal orders are traceable and can be replaced if lost or stolen. This provides peace of mind to both senders and recipients, knowing that their money is protected. Additionally, postal orders are widely accepted by businesses, government agencies, and individuals, making them a versatile option for a variety of transactions.

Another advantage of postal orders is their affordability. The fees associated with purchasing a postal order are typically much lower than those charged by money transfer services or banks. This makes them an affordable option for individuals who need to send money but want to avoid high transaction fees. Postal orders are also easy to use and don't require any special knowledge or technical skills, making them accessible to people of all ages and backgrounds.

Postal orders are also a convenient option for those who don't have access to traditional banking services or prefer not to share their banking details online. They provide a simple and straightforward way to transfer funds without the need for a bank account or internet access. This makes them an ideal choice for individuals who value security and simplicity in their financial transactions.

Disadvantages of Using Postal Orders

Despite their many advantages, postal orders also have a few drawbacks that should be considered. One of the main disadvantages is their limited availability. Postal orders can only be purchased at post offices, which may not be convenient for everyone, especially those living in remote areas. Additionally, the process of purchasing and sending a postal order can be time-consuming, as it requires a visit to the post office and waiting for the mail to be delivered.

Another potential disadvantage of postal orders is the risk of delays. Unlike digital payment methods, which are processed instantly, postal orders rely on the postal system, which can be subject to delays or disruptions. This can be a concern for time-sensitive transactions, where speed is of the essence. Additionally, postal orders may not be suitable for large transactions, as they typically have a maximum limit on the amount that can be sent.

Finally, postal orders may not be as widely accepted as other payment methods, such as credit cards or bank transfers. While they are accepted by many businesses and government agencies, some institutions may not accept postal orders as a form of payment. This can limit their usefulness in certain situations, particularly for international transactions or online purchases.

Can Postal Orders Be Traced or Replaced If Lost?

One of the key features of postal orders is their traceability, which provides an added layer of security for financial transactions. Each postal order is assigned a unique serial number, which allows it to be tracked through the postal system. This feature is particularly useful if the postal order is lost or stolen, as it enables the sender to report the issue and request a replacement.

To trace or replace a lost postal order, the sender will need to provide the serial number and any documentation issued by the post office at the time of purchase. This information is used to verify the authenticity of the postal order and ensure that it has not already been cashed. Once the issue has been reported, the post office will investigate the matter and, if necessary, issue a replacement postal order to the sender.

It's important to note that the process of tracing or replacing a lost postal order can take time, depending on the policies of the post office and the circumstances surrounding the loss. To minimize the risk of delays, it's advisable to keep a record of the serial number and other details in a safe place. Additionally, consider using registered or insured mail when sending postal orders to provide an extra layer of protection and ensure that they reach their destination safely.

How Do Postal Orders Compare to Money Orders and Bank Transfers?

Postal orders, money orders, and bank transfers are all popular methods of transferring funds, but they each have their own unique features and benefits. Postal orders are issued by postal authorities and are prepaid, meaning the sender must pay the full amount upfront. They are widely accepted by businesses and government agencies and can be traced if lost or stolen, making them a secure option for financial transactions.

Money orders, on the other hand, are similar to postal orders but are typically issued by banks, credit unions, or other financial institutions. Like postal orders, money orders are prepaid and can be traced if necessary. However, they often come with higher fees and may not be as widely accepted as postal orders. Additionally, money orders may require a bank account or other financial credentials, which can be a barrier for some individuals.

Bank transfers are another popular method of transferring funds, particularly for larger transactions. They are processed electronically and are typically faster than postal or money orders. However, bank transfers often come with higher fees and may require the sender and recipient to have bank accounts